AAVE调研报告

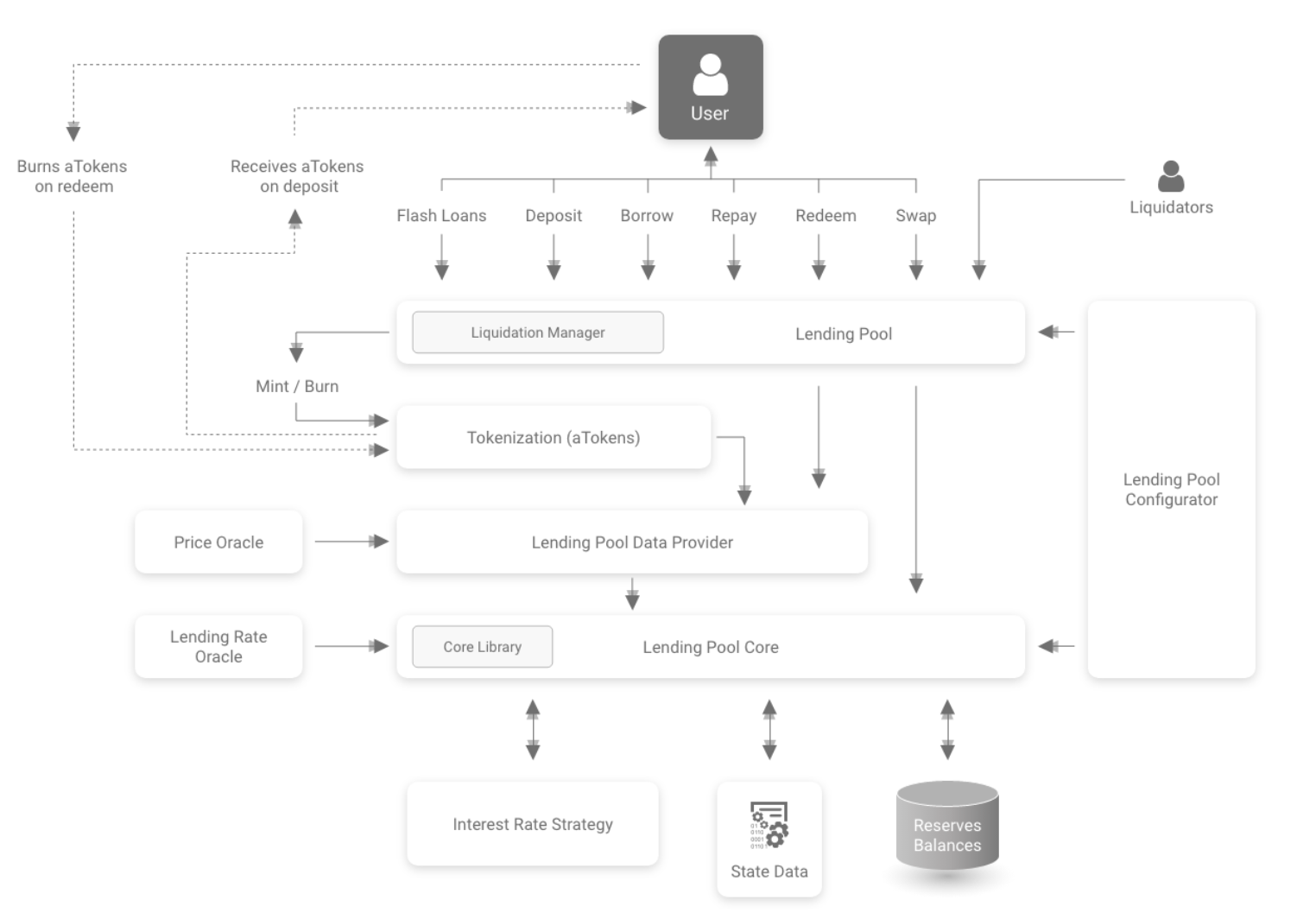

项目描述

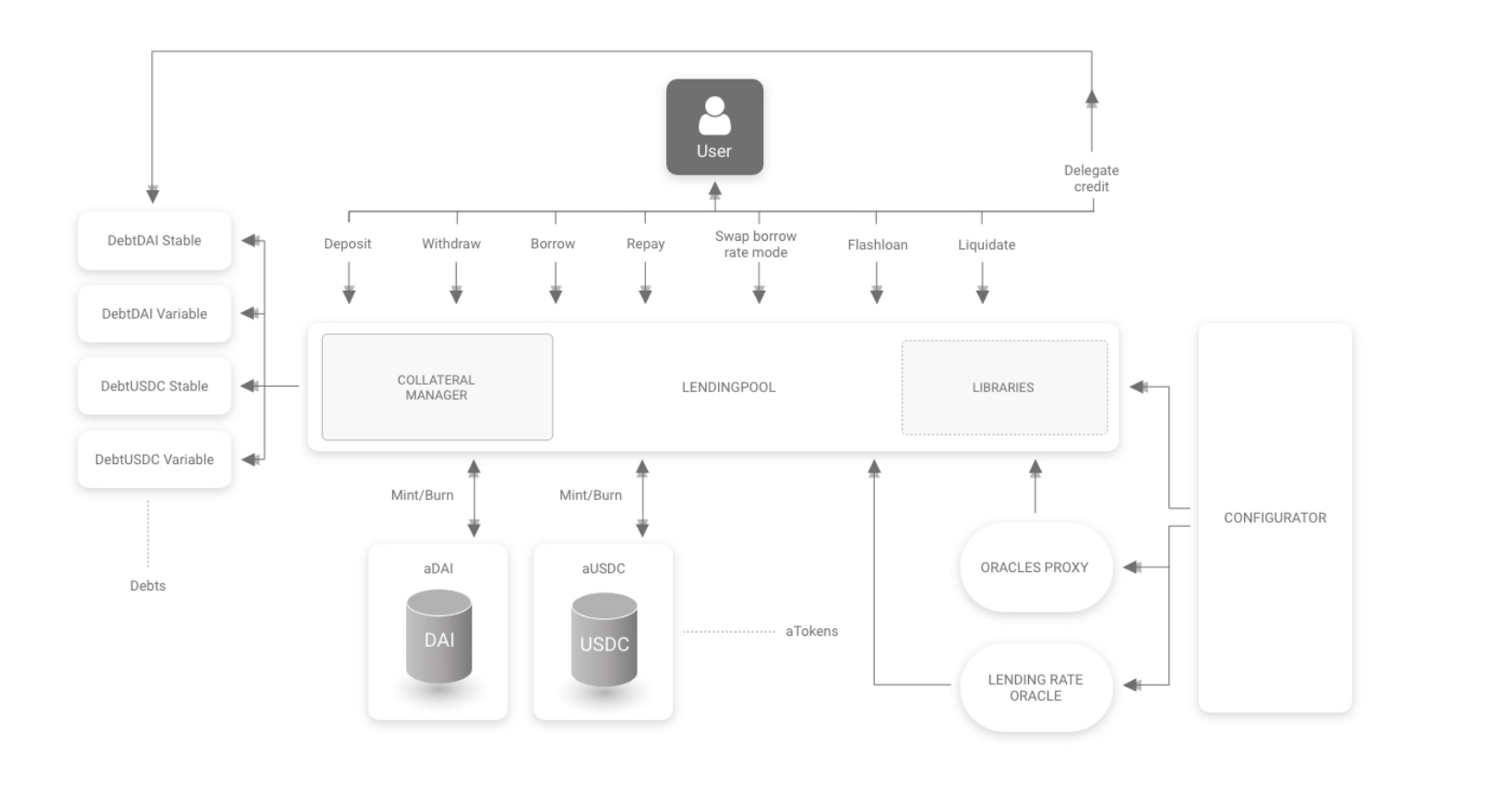

Aave是一种去中心化的基于以太坊的非托管开源协议,用户可以使用它赚取存款利息或者借入资产。同时,它还支持在无中介的情况下发放和获得贷款,首创了DEFI生态无抵押贷款模式(也就是闪电贷)。

AAVE的借贷池由管理者创建,对于每一个借贷池都对应一个特定的Atoken。用户存入的资产可以作为流动性挖矿的本金,同时也可以作为抵押借贷的抵押物。

对于投资者,想以AAVE项目获利的人来说,可以通过流动性挖矿的方式赚取稳定的收入;同时也可以通过清算抵押资产的方式来获取清算的奖励(折扣购买清算资产);也可以通过闪电贷的方式借取资产进行套利。

截止3.13日,AAVE项目在defi Pulse的排名为第四名,超过了uniswap,项目内资产超过176亿美金。

功能描述

目前市面上V2版本规模最大,V3版本还没有正式上线,这里着重分析概括V2版本的基本逻辑和功能,以提供一个项目的基本概念。

基础概念

术语

APY

Annual Percentage Yield,即年化利率。这里APY和APR(Annual Percentage Rate)是两个概念,APY有点类似利滚利,而APR是定死的收益。比如信用卡A的APR为每月1%,那么他最终在还款时需要还12%(1%*12)的利息。信用卡B的APY为每月1%,那么他最终一年还款需要12.68%((1+0.01)^12-1=12.68)。

LTV(Loan To Value)

贷款价值比,用于衡量抵押物和贷款的比值。比如用户抵押了100元的资产,LTV为80%,那么用户可以贷出来80元资产。在AAVE中,LTV的数值由用户抵押物来进行确定。

Liquidation Threshold

翻译过来就是清算阈值,用于标定抵押资产价值被清算的阈值。这个概念被用于金融领域,当借款用户抵押的资产价值总额低于这个阈值的时候就会被清算。比如用户抵押了100个ETH贷出了800个USDT,阈值被设定为80%,如果ETH或者USDT价格发生波动,当用户抵押的100个ETH的价值总额低于或等于640(800*80%)个USDT的时候,用户抵押的资产就会被清算拍卖。

Liquidation Bonus

清算奖励,用来奖励那些流动性提供者购买被清算资产的行为。那么被清算资产的判定是根据一个健康因子的参数,当这个参数高于1,这个资产就被定性为被清算资产。

Health factor

健康因子,用来判断一个抵押资产是否达到清算的标准,其实就是(抵押资产价值*清算阈值/借贷金额)。

Stable Rate

稳定利率,在短期贷款中可能保持一个固定的利率,但是在长期贷款中可能利率会根据市场价的波动而导致利率变化。

ray&wad

ray: 27位精度的十进制数

wad: 18位精度的十进制数

在solidity中,这两种表示都本质都是uint256。

项目内概念

reserve

表示的是每一个交易池的储备资产,每一个交易池都有不同的虚拟货币的储备,所有储备资产换算成ETH的总额被称之为这个交易池的总流动资金。储备资产接收用户的存储,用户同时也可以通过超额抵押资产的方式来借出这些资金,这些抵押就被标记为抵押资产。储备中的每一个资产都可以设置为抵押资产或者流动资产。

principal balance

借贷本金,指的是最初借款的金额。

compound balance

复合贷款金额,指的是借贷本金加利息,利息可能是稳定利率或者可变利率产生的。

liquidity index

当前(流动性本金+流动性挖矿奖励)/流动性本金。

liquidity rate

当前流动性奖励利率,也就是流动性挖矿奖励利率。

variable index

(可变利率贷款本金+可变利率贷款利息)/可变利率贷款本金。

variable rate

可变利率贷款利率。

stable index & stable rate

概念同上。

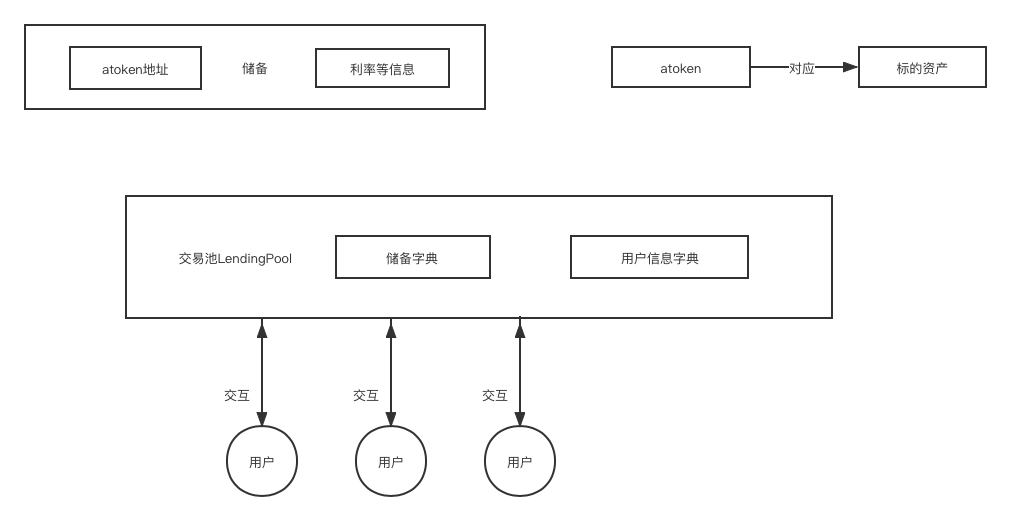

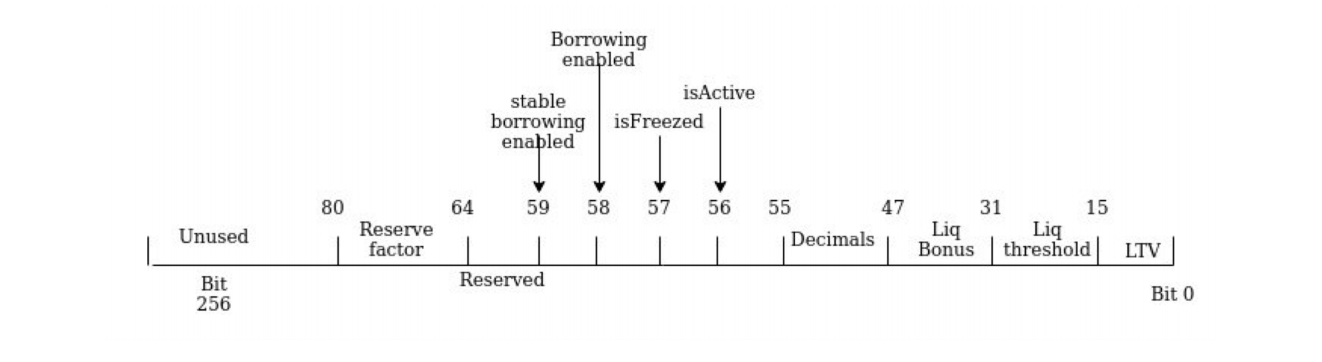

整体数据存储逻辑

资产存储和收益逻辑

AAVE交易池将不同资产划分成了各个独立的储备,用户通过调用交易池的存款函数来向储备中存储相应的标的资产。

每个储备都有一个特定的atoken为其服务,用户存入的资产会被等量的兑换成对应的atoken作为其财产凭证。

用户存入的资产可以作为抵押贷款的抵押物,同时也可以作为流动性提供给储备。

对于每一个特定的资产,用户都可以将其状态设置为抵押状态或者非抵押状态。区别在于抵押状态的财产可能受到未偿还债务影响不能随时随地取出(甚至可能被清算),两种状态都会产生流动性收益。

用户随时可以通过从交易池将自己存入的资产和产生的收益取出,不过前提需要满足以下条件其中之一:

- 用户没有借款

- 用户取出的资产没有作为抵押物

- 如果有借款且作为抵押物,那么需要保证取出资产后用户的贷款健康因子不低于预设的阈值。

收益来源

用户获得的收益来自于下面列出的来源:

- 贷款利息

- 闪电贷手续费

这里需要说明的是,用户提款的资金源自于各个储备的流动性,当流动性不足时(没人还款、抵押资产无人清算)可能会出现用户不能完全取出存款和收益的情况。

收益去向

- 用户流动性收益

- 协议方收取,在每一次交易池资产变动时的储备更新操作中,都会将收益的一部分(定义为每个储备金的reserveFactor)存储到treasury地址中。在这里需要说明,转到treasury的资产是以生成atoken的形式转入(mint利息的一部分),并没有直接在标的资产上做操作。

存入资金去向

用户在交易池中存储的标的资产最终都是将资产转移到atoken地址,然后atoken合约生成等量atoken交给用户作为用户的资产凭证。用户与交易池的一切操作最终的资产交互都是和atoken合约地址进行。

抵押借贷逻辑

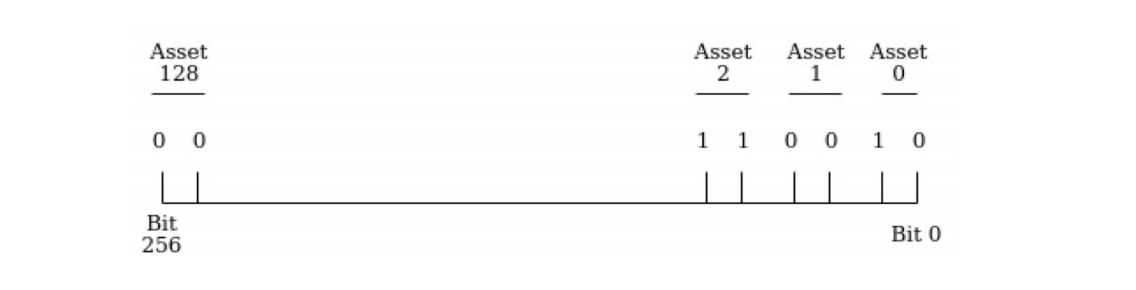

用户在AAVE规定范围内的所有抵押物资产都可以作为任何一个抵押贷款的抵押物,价值换算到ETH来进行衡量。

用户在每一个储备中产生的贷款(包括本金和利息)都以债务代币(debt token)的形式表示。债务代币本质是一个阉割版的ERC20token,只能由交易池进行铸币和销毁操作。

AAVE采用常规的超额抵押借贷逻辑,每一个交易池的资产都对应一个预设的ltv。

同时,用户也有一个加权平均的ltv,其值源自于用户所有贷款资产ltv的加权平均乘以用户所有抵押资产价值总和(avgLtv = totalValueToBorrow / totalCollateralValue)。

用户借款时,会通过用户的平均Ltv来计算新增的贷款数额对应的抵押物资产数额,需要满足当前抵押物资产数额大于借贷发生后的抵押物数额。(amountOfCollateralNeededETH <= vars.userCollateralBalanceETH)

用户抵押借贷不需要还款期限以及最低还款数额,用户甚至可以选择永远不还款等待清算。当用户的贷款健康因子低于一个阈值时,清算者就可以利用低价来购买被清算者的抵押资产。

在进行抵押借贷时,有两种利率模式可以选择:可变利率和稳定利率,二者在交易池中都有属于自己的债务代币实现,用于记录用户的贷款。用户也可以将手中的债务利率模式进行切换(前提是资产支持两种利率模式),不过在切换时会将其间产生的利息一起纳入借贷本金。

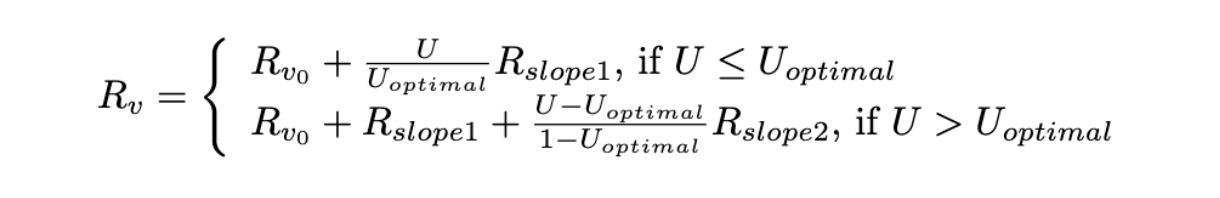

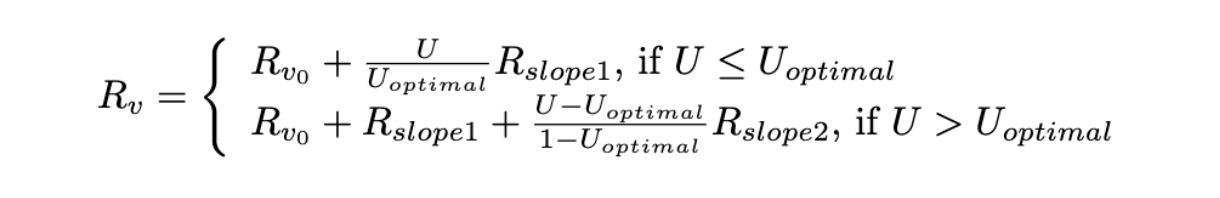

利率计算公式

稳定利率和可变利率的计算公式是一样的,如下:

二者的区别在于参数不同。

其中Rv0代表的是基础利率,U代表资金利用率,Uoptimal表示最佳利用率,为预先设定的值,Rslope1和Rslope2表示在达到最佳资产利用率前后的基准利率。

可以看到,在没有达到最佳利用率之前,利率主要根据Rslope1变化,在达到最佳利用率之后,主要根据Rslope2变化。整体的利率是和利用率正相关的。

也就是说,当交易池中流动性高时,低利率鼓励贷款;当流动性低时,高利率来维持流动性。

稳定利率和可变利率的区别

前小节提到,二者计算公式相同且在代码中更新时间顺序也相同。那么二者的最主要区别就在于上述公式中的Rv0、Rslope1、Rslope2以及Uoptimal参数的区别。

对于AAVE中各个资产的参数明细,在这里可以查询:https://docs.aave.com/risk/liquidity-risk/borrow-interest-rate

通过图表,可以明显看出其区别:

- 可变利率的Rv0(也就是基础利率)都是0,而稳定利率的Rv0则不为0为一个常数(在代码中稳定利率的基础利率是由预言机获取的市场平均利率)。

- 稳定利率的Rslope1普遍高于可变利率的Rslope1。

- 可变利率的Rslope2普遍显著高于稳定利率的Rslope2。

- 只有行情比较稳定的资产(如ETH、USDT等)才支持稳定利率。

所以,当交易池流动性较高时,可变利率会低于稳定利率;当流动性低时,可变利率会显著高于稳定利率。

对于支持稳定利率的资产,大多数都是投资者准备长期持有的,所以流动性一般不会过低。而对于其他次级代币,市场价格波动较大,交易池的流动性也不能保持稳定在最佳利用率以下,超过最佳利用率的话,那么利率会增长到一个可怕的数值。

所以对于准备长期借贷持有的币种,更推荐选择稳定利率:对于短期套利币种则可变利率是个更好的选择。

还款逻辑

对于抵押借贷产生的贷款,用户可以不限时间不限数额偿还债务。对于某一特定资产的债务,用户偿还时需要使用同一种资产偿还贷款。

清算逻辑

当用户的债务状况不佳,即健康因子低于一个阈值时,用户的抵押资产就可以被清算者清算,也就是将抵押资产拍卖还债。

这些被清算的资产会以一个折扣价出售给清算者,清算者可以选择以atoken的形式或者标的资产本身的方式来接受清算的抵押物。

与还款逻辑类似,清算者需要与债务资产相同的代币来清算被清算者的抵押资产。

AAVE市场

目前,AAVE协议运行在eth、polygon以及avalanche上。

AAVE实现了对AMM的流动性代币的交易市场(即支持AMM LP代币的抵押和借贷),由于LP代币的特殊性,AAVE对于每一个交易对都定义了其风险参数(也就是之前利率计算一节中公式参数),具体参考:https://docs.aave.com/risk/asset-risk/amm

eth:https://etherscan.io/address/0x7d2768de32b0b80b7a3454c06bdac94a69ddc7a9

polygon:https://polygonscan.com/address/0x8dff5e27ea6b7ac08ebfdf9eb090f32ee9a30fcf

avalanche:https://avascan.info/blockchain/c/address/0x4F01AeD16D97E3aB5ab2B501154DC9bb0F1A5A2C/transactions#tabletop

ETH部署(v2)

| 地址 | 名称 | 作用 |

|---|---|---|

| 0x7d2768dE32b0b80b7a3454c06BdAc94A69DDc7A9 | AAVE Lending Pool V2 | 用户与AAVE交互的接口 |

| 0x464C71f6c2F760DdA6093dCB91C24c39e5d6e18c | AAVE Tresury(Fee Collector) | 存储AAVE协议手续费 |

| 0xBcca60bB61934080951369a648Fb03DF4F96263C | aUSDC | 用户存入交易池资产最终流向的atoken地址,发送给用户等量的atoken,用于作为用户资产和收益凭证。 |

| 0x028171bCA77440897B824Ca71D1c56caC55b68A3 | aDAI | |

| 0x3Ed3B47Dd13EC9a98b44e6204A523E766B225811 | aUSDT | |

| 0x8dAE6Cb04688C62d939ed9B68d32Bc62e49970b1 | aCRV | |

| 0x6C5024Cd4F8A59110119C56f8933403A539555EB | aSUSD | |

| 0x101cc05f4A51C0319f570d5E146a8C625198e636 | aTUSD | |

| 0xc9BC48c72154ef3e5425641a3c747242112a46AF | aRAI | |

| 0x030bA81f1c18d280636F32af80b9AAd02Cf0854e | aWETH | |

| 0xa685a61171bb30d4072B338c80Cb7b2c865c873E | aMANA | |

| 0x5165d24277cD063F5ac44Efd447B27025e888f37 | aYFI | |

| 0xA361718326c15715591c299427c62086F69923D9 | aBUSD | |

| 0x35f6B052C598d933D69A4EEC4D04c73A191fE6c2 | aSNX | |

| 0x9ff58f4fFB29fA2266Ab25e75e2A8b3503311656 | aWBTC | |

| 0xD37EE7e4f452C6638c96536e68090De8cBcdb583 | aGUSD | |

| 0xd24946147829DEaA935bE2aD85A3291dbf109c80 | aAMMUSDC | amm市场的USDC atoken(名称中带有AMM的atoken地址与之类似) |

| 0x39C6b3e42d6A679d7D776778Fe880BC9487C2EDA | aKNC | |

| 0x17a79792Fe6fE5C95dFE95Fe3fCEE3CAf4fE4Cb7 | aAMMUSDT | |

| 0xf9Fb4AD91812b704Ba883B11d2B576E890a6730A | aAMMWETH | |

| 0x272F97b7a56a387aE942350bBC7Df5700f8a4576 | aBAL | |

| 0x79bE75FFC64DD58e66787E4Eae470c8a1FD08ba4 | aAMMDAI | |

| 0xc713e5E149D5D0715DcD1c156a020976e7E56B88 | aMKR | |

| 0xF256CC7847E919FAc9B808cC216cAc87CCF2f47a | aXSUSHI | |

| 0xB9D7CB55f463405CDfBe4E90a6D2Df01C2B92BF1 | aUNI | |

| 0xaC6Df26a590F08dcC95D5a4705ae8abbc88509Ef | aENJ | |

| 0xa06bC25B5805d5F8d82847D191Cb4Af5A3e873E0 | aLINK | |

| 0x05Ec93c0365baAeAbF7AefFb0972ea7ECdD39CF1 | aBAT | |

| 0xCC12AbE4ff81c9378D670De1b57F8e0Dd228D77a | aREN | |

| 0x13B2f6928D7204328b0E8E4BCd0379aA06EA21FA | aAMMWBTC | |

| 0xDf7FF54aAcAcbFf42dfe29DD6144A69b629f8C9e | aZRX | |

| 0x2e8F4bdbE3d47d7d7DE490437AeA9915D930F1A3 | aPAX | |

| 0x514cd6756CCBe28772d4Cb81bC3156BA9d1744aa | aRENFIL | |

| 0x1E6bb68Acec8fefBD87D192bE09bb274170a0548 | aAMPL | |

| 0x6F634c6135D2EBD550000ac92F494F9CB8183dAe | aDPI | |

| 0x9a14e23A58edf4EFDcB360f68cd1b95ce2081a2F | aENS | |

| 0x683923dB55Fead99A79Fa01A27EeC3cB19679cC3 | aFEI | |

| 0xd4937682df3C8aEF4FE912A96A74121C0829E664 | aFRAX |

polygon部署(v2)

| 地址 | 名称 | 作用 |

|---|---|---|

| 0x8dFf5E27EA6b7AC08EbFdf9eB090F32ee9a30fcf | AAVE Lending Pool V2 | 用户与AAVE交互的接口 |

| 0x7734280A4337F37Fbf4651073Db7c28C80B339e9 | AAVE Tresury(Fee Collector) | 存储AAVE协议手续费 |

| 0x1a13F4Ca1d028320A707D99520AbFefca3998b7F | amUSDC(AAVE MATIC Market USDC) | polygon(matic)网络的atoken,命名于L1不同,作用相同。 |

| 0x27F8D03b3a2196956ED754baDc28D73be8830A6e | amDAI | |

| 0x60D55F02A771d515e077c9C2403a1ef324885CeC | amUSDT | |

| 0x8dF3aad3a84da6b69A4DA8aeC3eA40d9091B2Ac4 | amWMATIC | |

| 0x5c2ed810328349100A66B82b78a1791B101C9D61 | amWBTC | |

| 0x28424507fefb6f7f8E9D3860F56504E4e5f5f390 | amWETH | |

| 0xc4195D4060DaEac44058Ed668AA5EfEc50D77ff6 | amBAL | |

| 0x3Df8f92b7E798820ddcCA2EBEA7BAbda2c90c4aD | amCRV | |

| 0x080b5BF8f360F624628E0fb961F4e67c9e3c7CF1 | amGHST | |

| 0x080b5BF8f360F624628E0fb961F4e67c9e3c7CF1 | amLINK |

avalanche部署(v2)

| 地址 | 名称 | 作用 |

|---|---|---|

| 0x4F01AeD16D97E3aB5ab2B501154DC9bb0F1A5A2C | AAVE Lending Pool V2 | 用户与AAVE交互的接口 |

| 0x467b92aF281d14cB6809913AD016a607b5ba8A36 | AAVE Treasury(Fee Collector) | 存储AAVE协议手续费 |

| 0x47AFa96Cdc9fAb46904A55a6ad4bf6660B53c38a | avDAI(AAVE Avalanche DAI) | Avalanche网络的atoken。 |

| 0xDFE521292EcE2A4f44242efBcD66Bc594CA9714B | avWAVAX | |

| 0x53f7c5869a859F0AeC3D334ee8B4Cf01E3492f21 | avWETH | |

| 0x46A51127C3ce23fb7AB1DE06226147F446e4a857 | avUSDC | |

| 0x532E6537FEA298397212F09A61e03311686f548e | avUSDT | |

| 0x686bEF2417b6Dc32C50a3cBfbCC3bb60E1e9a15D | avWBTC |

AAVE代币

AAVE本身也发行了自己项目代币AAVE,同时在AAVE本身交易市场中,AAVE代币会有更高的效率(低利率高ltv等)。

除此之外,AAVE代币的重要功能就是参与AAVE项目社区的维护,作为DAO的投票使用。

总共发行了 16,000,000 个 AAVE。13,000,000 AAVE 分配给用户,其余 3,000,000 AAVE 分配给生态系统储备。

| 角色 | 平均持币数量 | 比例 |

|---|---|---|

| 项目方 | 416 | 26% |

| 散户 | 520 | 33% |

| 交易所 | 264 | 17% |

| 合约+挖矿奖励 | 400 | 25% |

代币质押

为了保证AAVE协议的安全性,AAVE协议鼓励AAVE代币持有者将持有的AAVE代币质押到AAVE协议中。这些被质押的AAVE代币的状态被称之为安全模式,安全模式中的AAVE质押代币用于应对一些协议运行中出现的亏空风险,用户存入安全模式的质押代币需要被锁定一段时间后才能被用户取出。

注意,AAVE AMM市场的交易池目前不受到安全模式的保护。

亏空风险定义为:

- 合约漏洞利用。

- 流动性不足,抵押资产无人清算。

- 预言机失灵。

当出现亏空时,部分质押AAVE代币会在市场上抛售来弥补协议中出现的财务缺口;抛售流程中有防护措施来限制抛售的AAVE代币数量,防止大量的AAVE代币流入市场进一步造成AAVE代币价格下跌。

对于将持有AAVE代币并将其质押在AAVE协议中的用户,他们承担了风险,所以AAVE协议会给予这些质押AAVE代币的持有人奖励。质押者获得的质押奖励来自于项目方的AAVE代币储备以及部分协议手续费用。

项目治理

AAVE改进建议(AIP)包括了AAVE项目中参数的变动(利息参数、奖励系数等)、协议的改进以及管理措施的改进。AAVE代币持有者可以在管理社区发布新的AIP,当新的AIP被管理者采纳,会发起一个投票,AAVE代币的持有者通过手中的AAVE代币来决定提案是否通过。注意,质押的AAVE代币同样可以作为投票使用。

基本调用流程

前置概念

由于EVM不能自己运行,所以每次涉及到交易池资金变动的操作都会调用交易池的更新函数,更新贷款总量、利率以及流动资金总量,同时将产生的利息以mint等量的atoken的形式存储到treasury中。

对于atoken和债务代币,每个用户的本金是一个缩减后的量(scaled amount)。

比如APY为20%(也就是用户存入100元一年后可以取出120元)用户如果在交易池初始化时投入100元,那么这个缩减后的存款为100;如果用户在交易池创建一年后存入120元,那么这个缩减后的存款同样为100元。(债务代币同理)

也就是说,用户的存款会被缩减到对标交易池初始化时的比率,方便计算。

基本功能介绍中,采用的样例版本为V2,详细逻辑见后续的代码分析一节。

基本用户所有的操作都是和LendingPool合约交互进行的。

deposit

场景:用户将手中的资产存入对应的交易池中,或用于流动性挖矿或用于抵押借款。

函数接口:

function deposit(address asset, uint256 amount, address onBehalfOf, uint16 referralCode)

参数说明:

- asset:将要存入AAVE协议的资产。

- amount:存入数量

- onBehalfOf:接收atoken的地址

- referralCode:用于标记操作源,0表示没有中间人。

函数逻辑:

- 检查对应的交易池状态是否允许存款

- 更新交易池状态

- 将用户手中的资产转移到交易池对应的atoken中,生成对等的atoken给用户作为资产凭证。

- 如果用户是第一次存储此类资产,则默认将此资产作为抵押物。

资金流:用户资产从用户手中流向到了atoken地址,atoken合约生成等量的atoken给用户。

withdraw

场景:用户将存储在交易池中一定数量的资产以及产生的收益取回。

函数原型:

function withdraw(address asset,uint256 amount,address to) external override whenNotPaused returns (uint256)

参数说明:

- asset:用户将要取回的资产。

- amount:用户想要取回的资产数量(本金+利息)。

- to:接收取回资产的地址。

- 返回值:最终成功取回的资产数量。

函数逻辑:

-

检查是否允许用户取回该数目的资产:

-

1) 交易池状态是否激活。

-

- 如果用户名下没有贷款或者该资产用户没有将其作为抵押资产,则可以取回。

-

- 如果用户名下有贷款,且该资产作为抵押物,会判断如果取回该资产后用户的健康因子是否超过阈值,如果超过则不允许取出。z注意:判断抵押资产价值时考虑了抵押资产的本金和产生的收益。

-

如果可以取出,那么更新交易池状态。

-

如果用户将该交易池中的所有资产取出,则将用户的在该资产的状态设置为非抵押状态。

- 销毁atokens,将资产转出给用户。

资金流:若成功执行,则atoken将所持有的amount数量的asset资产转向用户设置的to地址。

borrow

场景:用户通过自己在其他资产的抵押借去特定数目的目标资产。

函数原型:

function borrow(address asset,uint256 amount,uint256 interestRateMode,uint16 referralCode, address onBehalfOf)

参数说明:

- asset:用户想要借取的资产。

- amount:贷款数额

- interestMode:利率模式

- referralCode:用于标记操作源,0表示没有中间人。

函数逻辑:

-

计算借出特定数量的目标资产的ETH对标价值(通过预言机)。

-

检查是否允许借款:

-

- 检查交易池状态是否允许借款。

-

- 检查用户的健康因子、当前剩余抵押资产是否能够满足用户的借款需求。

-

- 如果用户选择稳定利率模式进行贷款,则交易池需要开启稳定利率模式且用户不可以拥有目标资产的抵押资产。

-

- 用户贷款数额需小于交易池目前最高的贷款限额

-

更新交易池状态

-

根据用户选择的贷款利率模式,生成对应的债务代币,并更新对应的利率信息。注意,在这里借出去的

- 将贷款转移到借贷者账户。

资金流:若执行成功,则atoken会将所持有的标的资产转给onBehalfOf地址,并且在对应利率模式下给用户生成贷款代币。

repay

场景:用户偿还特定数量的目标资产特定利率模式的贷款。

函数原型:

function repay( address asset,uint256 amount,uint256 rateMode,address onBehalfOf) external override whenNotPaused returns (uint256)

参数说明:

- asset:用户偿还的贷款资产

- amount:偿还数额

- rateMode:利率模式

- onBehalfOf:贷款偿还人(借贷者)

- 返回值:最终偿还数额。

函数逻辑:

- 计算用户在当前交易池的欠款额以及利率模式。

- 检查当前储备状态是否激活,用户在当前利率模式下是否有欠款。

- 销毁指定数量的利率模式债务代币。

- 更新交易池状态。

- 如果用户还清了欠款,则将用户在此交易池的借贷状态设置为false。

- 将用户的atoken转到交易池。

资金流:用户将资产转移到atoken中,销毁onBehalfOf的贷款代币。

liquidation

场景:清算者购买被清算者一定数量的抵押资产(collateral asset)来偿还被清算者特定资产债务(debt asset)

函数原型:

function liquidationCall(address collateralAsset,address debtAsset,address user,uint256 debtToCover,bool receiveAToken)

参数说明:

- collateralAsset:清算者(用户)想要购买的抵押资产。

- debtAsset:被清算者的债务资产,同时也是清算者要支付的资产。

- user:被清算者

- debtToCover:替被清算者偿还的贷款额

- receiveAToken:清算者是否以atoken的形式接收清算得到的抵押资产。

函数逻辑:

- 检查用户的债务信息以及健康因子是否达到清算标准,并且用户是否持有该抵押资产。

- 计算用户在debt asset中的总贷款额,计算出实际能够被清算的贷款数额。

- 更新债务资产状态。

- 销毁对应的债务代币。(优先销毁可变利率债务)

- 更新债务资产利率。

- 如果清算者接收atoken则将抵押资产对应的atoken转入清算者账户;否则将抵押资产转入清算者地址并更新交易池状态(因为减少了流动性)。

- 最后,将清算者用于购买的资产(debt token)转入到交易池中。

资金流:清算者将用于购买的债务资产转移到atoken,atoken将抵押物或者抵押物对应的atoken转移到清算者,销毁被清算者的一部分债务代币。

flash loan

场景:闪电贷接口,用户可以一次贷出多个资产,并且在还款时可以选择用债务的方式偿还闪电贷。

函数原型:

function flashLoan(

address receiverAddress,

address[] calldata assets,

uint256[] calldata amounts,

uint256[] calldata modes,

address onBehalfOf,

bytes calldata params,

uint16 referralCode

)

参数说明:

- receiverAddress:接收闪电贷贷款的地址,需要为合约执行receive逻辑。

- assets:用户选择借贷的一系列资产地址。

- amounts:对应的资产数额

- modes:对应的还款逻辑,0为正常闪电贷还款,1为稳定利率模式,2为可变利率模式

- onBehalfOf:如果选择贷款还款,承担债务方。

- params:传递给闪电贷接受函数的参数

- referralCode:用于标记操作源,0表示没有中间人。

函数逻辑:

- 检查传入参数数组的大小是否对其

- 计算各个资产的手续费,转款给receiver

- 判断闪电贷还款是否成功

- 如果模式为0,没有还完款直接revert

- 如果模式为1或者2,则执行前面提到的抵押贷款逻辑,债务由onBehalfOf承担。

资金流:由各个资产对应的atoken传入给receiver,再由receiver的还款逻辑,如果正常执行完闪电贷,则直接从receiver转到对应的atoken;如果选择抵押借贷还款,则部分资金可能由receiver转到对应的atoken,其余的欠款以生成对应的债务代币的方式由onBehalfOf承担。

代码分析

v0

ETHLend立项于2017年,是一个构设在以太坊上的Dapp。ETHLend旨在通过取消大型金融机构和传统银行的控制权和权力,使复杂的贷款程序民主化,使贷款人和借款人能够在不需要中间人的情况下决定贷款的重要细节。这意味着全世界的买方和贷方都可以根据自己的条款创建贷款合约,实现区块链上的点对点借贷。

借款人在ETHLend平台上创建贷款请求。对于提出贷款申请,借款人应设置数据,如贷款的持续时间,抵押资产和利息。

如果贷方同意这些条款,则可以创建贷款协议。到期限后,如果借款方没有偿还所有的债务以及利息,那么贷方就会将抵押资产收走。

ETHLend是AAVE的雏形,这个项目现在已经被废弃,这里不做过多讨论。

v1

实现功能

v1版本的出现使得之前的ETHLend项目从一个去中心化的P2P借贷平台转换成了一个基于交易池的平台,用户可以通过交易池里存储虚拟货币的方式提供流动资产,同时其他用户也可以进行抵押贷款(永久时限)或者闪电贷。

整体架构

项目组成:

├── configuration

│ ├── AddressStorage.sol

│ ├── LendingPoolAddressesProvider.sol

│ ├── LendingPoolParametersProvider.sol

│ └── UintStorage.sol

├── fees

│ ├── FeeProvider.sol

│ └── TokenDistributor.sol

├── flashloan

│ ├── base

│ │ └── FlashLoanReceiverBase.sol

│ └── interfaces

│ └── IFlashLoanReceiver.sol

├── interfaces

│ ├── IChainlinkAggregator.sol

│ ├── IFeeProvider.sol

│ ├── IKyberNetworkProxyInterface.sol

│ ├── ILendingPoolAddressesProvider.sol

│ ├── ILendingRateOracle.sol

│ ├── IPriceOracle.sol

│ ├── IPriceOracleGetter.sol

│ └── IReserveInterestRateStrategy.sol

├── lendingpool

│ ├── DefaultReserveInterestRateStrategy.sol

│ ├── LendingPool.sol

│ ├── LendingPoolConfigurator.sol

│ ├── LendingPoolCore.sol

│ ├── LendingPoolDataProvider.sol

│ └── LendingPoolLiquidationManager.sol

├── libraries

│ ├── CoreLibrary.sol

│ ├── EthAddressLib.sol

│ ├── WadRayMath.sol

│ └── openzeppelin-upgradeability

│ ├── AdminUpgradeabilityProxy.sol

│ ├── BaseAdminUpgradeabilityProxy.sol

│ ├── BaseUpgradeabilityProxy.sol

│ ├── Initializable.sol

│ ├── InitializableAdminUpgradeabilityProxy.sol

│ ├── InitializableUpgradeabilityProxy.sol

│ ├── Proxy.sol

│ ├── UpgradeabilityProxy.sol

│ └── VersionedInitializable.sol

├── misc

│ ├── ChainlinkProxyPriceProvider.sol

│ ├── IERC20DetailedBytes.sol

│ └── WalletBalanceProvider.sol

├── mocks

│ ├── flashloan

│ │ └── MockFlashLoanReceiver.sol

│ ├── oracle

│ │ ├── CLAggregators

│ │ │ ├── MockAggregatorBAT.sol

│ │ │ ├── MockAggregatorBase.sol

│ │ │ ├── MockAggregatorDAI.sol

│ │ │ ├── MockAggregatorKNC.sol

│ │ │ ├── MockAggregatorLEND.sol

│ │ │ ├── MockAggregatorLINK.sol

│ │ │ ├── MockAggregatorMANA.sol

│ │ │ ├── MockAggregatorMKR.sol

│ │ │ ├── MockAggregatorREP.sol

│ │ │ ├── MockAggregatorSUSD.sol

│ │ │ ├── MockAggregatorTUSD.sol

│ │ │ ├── MockAggregatorUSDC.sol

│ │ │ ├── MockAggregatorUSDT.sol

│ │ │ ├── MockAggregatorWBTC.sol

│ │ │ └── MockAggregatorZRX.sol

│ │ ├── GenericOracleI.sol

│ │ ├── LendingRateOracle.sol

│ │ └── PriceOracle.sol

│ ├── tokens

│ │ ├── MintableERC20.sol

│ │ ├── MockBAT.sol

│ │ ├── MockDAI.sol

│ │ ├── MockKNC.sol

│ │ ├── MockLEND.sol

│ │ ├── MockLINK.sol

│ │ ├── MockMANA.sol

│ │ ├── MockMKR.sol

│ │ ├── MockREP.sol

│ │ ├── MockSUSD.sol

│ │ ├── MockTUSD.sol

│ │ ├── MockUSDC.sol

│ │ ├── MockUSDT.sol

│ │ ├── MockWBTC.sol

│ │ └── MockZRX.sol

│ └── upgradeability

│ └── MockLendingPoolCore.sol

└── tokenization

└── AToken.sol

核心合约

lendingpool

lendingpool目录下的合约是整个项目中最核心关键的部分。

DefaultReserveInterestRateStrategy.sol

用于计算和更新特定储备(reserve)的利率,每一个特定的储备都有一个特定的DefaultReserveInterestRateStrategy合约来为其服务。在这一合约中,定义了如下变量:

- 基础可变利率R0

- 低于最佳利用率的斜率Rslope1

- 高于最佳利用的斜率Rslope2

利率计算公式如下:

对于浮动利率和稳定利率,其计算公式是一样的,只不过是参数不同。

从代码中可以看出,公示中的利用率u其实就是储备(reserve)中的借贷总额 /(总流动资产+借贷总额),当这一比率大于或小于等于预先设定的阈值(optimal utilization)时(在这里这一比值被设定为80%),会得出不一样的利率,具体参考上面的公式。

而公式的结果R和U是正相关,也就是说资金利用率越高,利率越高;利用率越低则利率越低。

首先会从预言机获取市场平均的利率currentStableBorrowRate,以此作为稳定利率(stable rate)的Rv0。而可变利率的Rv0则是在合约内部初始化时设置。

根据当前利用率U与最佳利用率的大小来通过不同的公式来计算可变利率与稳定利率的数值(见上面公式)。

而后计算总借贷利率((可变利率贷款总额*可变利率+稳定利率贷款总额*稳定利率)/总贷款额),得到最后的流动性挖矿利率(总贷款利率*总利用率)。

最后将结果返回。

代码实现:

function calculateInterestRates(

address _reserve,

uint256 _availableLiquidity,

uint256 _totalBorrowsStable,

uint256 _totalBorrowsVariable,

uint256 _averageStableBorrowRate

)

external

view

returns (

uint256 currentLiquidityRate,

uint256 currentStableBorrowRate,

uint256 currentVariableBorrowRate

)

{

uint256 totalBorrows = _totalBorrowsStable.add(_totalBorrowsVariable);

uint256 utilizationRate = (totalBorrows == 0 && _availableLiquidity == 0)

? 0

: totalBorrows.rayDiv(_availableLiquidity.add(totalBorrows));

currentStableBorrowRate = ILendingRateOracle(addressesProvider.getLendingRateOracle())

.getMarketBorrowRate(_reserve);

if (utilizationRate > OPTIMAL_UTILIZATION_RATE) {

uint256 excessUtilizationRateRatio = utilizationRate

.sub(OPTIMAL_UTILIZATION_RATE)

.rayDiv(EXCESS_UTILIZATION_RATE);

currentStableBorrowRate = currentStableBorrowRate.add(stableRateSlope1).add(

stableRateSlope2.rayMul(excessUtilizationRateRatio)

);

currentVariableBorrowRate = baseVariableBorrowRate.add(variableRateSlope1).add(

variableRateSlope2.rayMul(excessUtilizationRateRatio)

);

} else {

currentStableBorrowRate = currentStableBorrowRate.add(

stableRateSlope1.rayMul(

utilizationRate.rayDiv(

OPTIMAL_UTILIZATION_RATE

)

)

);

currentVariableBorrowRate = baseVariableBorrowRate.add(

utilizationRate.rayDiv(OPTIMAL_UTILIZATION_RATE).rayMul(variableRateSlope1)

);

}

currentLiquidityRate = getOverallBorrowRateInternal(

_totalBorrowsStable,

_totalBorrowsVariable,

currentVariableBorrowRate,

_averageStableBorrowRate

)

.rayMul(utilizationRate);

}

function getOverallBorrowRateInternal(

uint256 _totalBorrowsStable,

uint256 _totalBorrowsVariable,

uint256 _currentVariableBorrowRate,

uint256 _currentAverageStableBorrowRate

) internal pure returns (uint256) {

uint256 totalBorrows = _totalBorrowsStable.add(_totalBorrowsVariable);

if (totalBorrows == 0) return 0;

uint256 weightedVariableRate = _totalBorrowsVariable.wadToRay().rayMul(

_currentVariableBorrowRate

);

uint256 weightedStableRate = _totalBorrowsStable.wadToRay().rayMul(

_currentAverageStableBorrowRate

);

uint256 overallBorrowRate = weightedVariableRate.add(weightedStableRate).rayDiv(

totalBorrows.wadToRay()

);

return overallBorrowRate;

}

LendingPool.sol

LendingPool合约是整个V1版本用户与协议交互的接口,通过与core合约交互实现了一整套用户借贷、流动性挖矿的逻辑。

用户通过deposit函数向协议存款时,可以选择ERC20token资产或者ETH,不可以两者混用,如果是ETH的话那么reserve地址就是0xEEEE…EEEE。主要逻辑就是调用core合约的更新储备状态函数,而后mint出一笔新的atoken作为用户的资产凭证,随后通过core合约向储备地址转款。其中referralCode只在最后的emit事件时使用,用于判断用户是否会接受奖励。

/**

* @dev deposits The underlying asset into the reserve. A corresponding amount of the overlying asset (aTokens)

* is minted.

* @param _reserve the address of the reserve

* @param _amount the amount to be deposited

* @param _referralCode integrators are assigned a referral code and can potentially receive rewards.

**/

function deposit(address _reserve, uint256 _amount, uint16 _referralCode)

external

payable

nonReentrant

onlyActiveReserve(_reserve)

onlyUnfreezedReserve(_reserve)

onlyAmountGreaterThanZero(_amount)

{

AToken aToken = AToken(core.getReserveATokenAddress(_reserve));

bool isFirstDeposit = aToken.balanceOf(msg.sender) == 0;

core.updateStateOnDeposit(_reserve, msg.sender, _amount, isFirstDeposit);

//minting AToken to user 1:1 with the specific exchange rate

aToken.mintOnDeposit(msg.sender, _amount);

//transfer to the core contract

core.transferToReserve.value(msg.value)(_reserve, msg.sender, _amount);

//solium-disable-next-line

emit Deposit(_reserve, msg.sender, _amount, _referralCode, block.timestamp);

}

用户可以通过redeemUnderlying来赎回标的资产,首先会判断储备中是否有足够的流动资金来满足用户的赎回操作,而后通过core合约的updateStateOnRedeem和transferToUser来完成更新储备信息和转款操作。

/**

* @dev Redeems the underlying amount of assets requested by _user.

* This function is executed by the overlying aToken contract in response to a redeem action.

* @param _reserve the address of the reserve

* @param _user the address of the user performing the action

* @param _amount the underlying amount to be redeemed

**/

function redeemUnderlying(

address _reserve,

address payable _user,

uint256 _amount,

uint256 _aTokenBalanceAfterRedeem

)

external

nonReentrant

onlyOverlyingAToken(_reserve)

onlyActiveReserve(_reserve)

onlyAmountGreaterThanZero(_amount)

{

uint256 currentAvailableLiquidity = core.getReserveAvailableLiquidity(_reserve);

require(

currentAvailableLiquidity >= _amount,

"There is not enough liquidity available to redeem"

);

core.updateStateOnRedeem(_reserve, _user, _amount, _aTokenBalanceAfterRedeem == 0);

core.transferToUser(_reserve, _user, _amount);

//solium-disable-next-line

emit RedeemUnderlying(_reserve, _user, _amount, block.timestamp);

}

对于借款的逻辑,为了缩减局部变量,使用了一个结构体来当作局部的用户全局信息。首先会检查用户借贷的目标储备是否允许借贷,确定借款利率模式以及有没有足够的储备金。随后计算当前发起借款用户的抵押资金、借贷总额、总手续费、当前LTV、清算阈值以及健康因子。当上述条件都满足后会计算当前借款的必须抵押资金,只有抵押金额大于借款额后才会调用core合约执行转账逻辑,将借出款从储备中转给用户。

/**

* @dev data structures for local computations in the borrow() method.

*/

struct BorrowLocalVars {

uint256 principalBorrowBalance;

uint256 currentLtv;

uint256 currentLiquidationThreshold;

uint256 borrowFee;

uint256 requestedBorrowAmountETH;

uint256 amountOfCollateralNeededETH;

uint256 userCollateralBalanceETH;

uint256 userBorrowBalanceETH;

uint256 userTotalFeesETH;

uint256 borrowBalanceIncrease;

uint256 currentReserveStableRate;

uint256 availableLiquidity;

uint256 reserveDecimals;

uint256 finalUserBorrowRate;

CoreLibrary.InterestRateMode rateMode;

bool healthFactorBelowThreshold;

}

/**

* @dev Allows users to borrow a specific amount of the reserve currency, provided that the borrower

* already deposited enough collateral.

* @param _reserve the address of the reserve

* @param _amount the amount to be borrowed

* @param _interestRateMode the interest rate mode at which the user wants to borrow. Can be 0 (STABLE) or 1 (VARIABLE)

**/

function borrow(

address _reserve,

uint256 _amount,

uint256 _interestRateMode,

uint16 _referralCode

)

external

nonReentrant

onlyActiveReserve(_reserve)

onlyUnfreezedReserve(_reserve)

onlyAmountGreaterThanZero(_amount)

{

// Usage of a memory struct of vars to avoid "Stack too deep" errors due to local variables

BorrowLocalVars memory vars;

//check that the reserve is enabled for borrowing

require(core.isReserveBorrowingEnabled(_reserve), "Reserve is not enabled for borrowing");

//validate interest rate mode

require(

uint256(CoreLibrary.InterestRateMode.VARIABLE) == _interestRateMode ||

uint256(CoreLibrary.InterestRateMode.STABLE) == _interestRateMode,

"Invalid interest rate mode selected"

);

//cast the rateMode to coreLibrary.interestRateMode

vars.rateMode = CoreLibrary.InterestRateMode(_interestRateMode);

//check that the amount is available in the reserve

vars.availableLiquidity = core.getReserveAvailableLiquidity(_reserve);

require(

vars.availableLiquidity >= _amount,

"There is not enough liquidity available in the reserve"

);

(

,

vars.userCollateralBalanceETH,

vars.userBorrowBalanceETH,

vars.userTotalFeesETH,

vars.currentLtv,

vars.currentLiquidationThreshold,

,

vars.healthFactorBelowThreshold

) = dataProvider.calculateUserGlobalData(msg.sender);

require(vars.userCollateralBalanceETH > 0, "The collateral balance is 0");

require(

!vars.healthFactorBelowThreshold,

"The borrower can already be liquidated so he cannot borrow more"

);

//calculating fees

vars.borrowFee = feeProvider.calculateLoanOriginationFee(msg.sender, _amount);

require(vars.borrowFee > 0, "The amount to borrow is too small");

vars.amountOfCollateralNeededETH = dataProvider.calculateCollateralNeededInETH(

_reserve,

_amount,

vars.borrowFee,

vars.userBorrowBalanceETH,

vars.userTotalFeesETH,

vars.currentLtv

);

require(

vars.amountOfCollateralNeededETH <= vars.userCollateralBalanceETH,

"There is not enough collateral to cover a new borrow"

);

/**

* Following conditions need to be met if the user is borrowing at a stable rate:

* 1. Reserve must be enabled for stable rate borrowing

* 2. Users cannot borrow from the reserve if their collateral is (mostly) the same currency

* they are borrowing, to prevent abuses.

* 3. Users will be able to borrow only a relatively small, configurable amount of the total

* liquidity

**/

if (vars.rateMode == CoreLibrary.InterestRateMode.STABLE) {

//check if the borrow mode is stable and if stable rate borrowing is enabled on this reserve

require(

core.isUserAllowedToBorrowAtStable(_reserve, msg.sender, _amount),

"User cannot borrow the selected amount with a stable rate"

);

//calculate the max available loan size in stable rate mode as a percentage of the

//available liquidity

uint256 maxLoanPercent = parametersProvider.getMaxStableRateBorrowSizePercent();

uint256 maxLoanSizeStable = vars.availableLiquidity.mul(maxLoanPercent).div(100);

require(

_amount <= maxLoanSizeStable,

"User is trying to borrow too much liquidity at a stable rate"

);

}

//all conditions passed - borrow is accepted

(vars.finalUserBorrowRate, vars.borrowBalanceIncrease) = core.updateStateOnBorrow(

_reserve,

msg.sender,

_amount,

vars.borrowFee,

vars.rateMode

);

//if we reached this point, we can transfer

core.transferToUser(_reserve, msg.sender, _amount);

emit Borrow(

_reserve,

msg.sender,

_amount,

_interestRateMode,

vars.finalUserBorrowRate,

vars.borrowFee,

vars.borrowBalanceIncrease,

_referralCode,

//solium-disable-next-line

block.timestamp

);

}

用户可以通过repay函数来偿还贷款,不过没有金额的限制,还款金额为-1时代表全部还款。

首先计算用户当前欠款额、利息、办理手续费等信息,而后计算出用户的所需还款具体数目(本金+利息+手续费)。如果用户的还款额度小于手续费数目,那么协议优先考虑将用户的还款转入手续费收集地址;如果用户还款的额度大于没有还清的手续费,那么一样的优先偿还手续费。剩下的金额才会转入用户借款储备地址。

/**

* @notice repays a borrow on the specific reserve, for the specified amount (or for the whole amount, if uint256(-1) is specified).

* @dev the target user is defined by _onBehalfOf. If there is no repayment on behalf of another account,

* _onBehalfOf must be equal to msg.sender.

* @param _reserve the address of the reserve on which the user borrowed

* @param _amount the amount to repay, or uint256(-1) if the user wants to repay everything

* @param _onBehalfOf the address for which msg.sender is repaying.

**/

struct RepayLocalVars {

uint256 principalBorrowBalance;

uint256 compoundedBorrowBalance;

uint256 borrowBalanceIncrease;

bool isETH;

uint256 paybackAmount;

uint256 paybackAmountMinusFees;

uint256 currentStableRate;

uint256 originationFee;

}

function repay(address _reserve, uint256 _amount, address payable _onBehalfOf)

external

payable

nonReentrant

onlyActiveReserve(_reserve)

onlyAmountGreaterThanZero(_amount)

{

// Usage of a memory struct of vars to avoid "Stack too deep" errors due to local variables

RepayLocalVars memory vars;

(

vars.principalBorrowBalance,

vars.compoundedBorrowBalance,

vars.borrowBalanceIncrease

) = core.getUserBorrowBalances(_reserve, _onBehalfOf);

vars.originationFee = core.getUserOriginationFee(_reserve, _onBehalfOf);

vars.isETH = EthAddressLib.ethAddress() == _reserve;

require(vars.compoundedBorrowBalance > 0, "The user does not have any borrow pending");

require(

_amount != UINT_MAX_VALUE || msg.sender == _onBehalfOf,

"To repay on behalf of an user an explicit amount to repay is needed."

);

//default to max amount

vars.paybackAmount = vars.compoundedBorrowBalance.add(vars.originationFee);

if (_amount != UINT_MAX_VALUE && _amount < vars.paybackAmount) {

vars.paybackAmount = _amount;

}

require(

!vars.isETH || msg.value >= vars.paybackAmount,

"Invalid msg.value sent for the repayment"

);

//if the amount is smaller than the origination fee, just transfer the amount to the fee destination address

if (vars.paybackAmount <= vars.originationFee) {

core.updateStateOnRepay(

_reserve,

_onBehalfOf,

0,

vars.paybackAmount,

vars.borrowBalanceIncrease,

false

);

core.transferToFeeCollectionAddress.value(vars.isETH ? vars.paybackAmount : 0)(

_reserve,

_onBehalfOf,

vars.paybackAmount,

addressesProvider.getTokenDistributor()

);

emit Repay(

_reserve,

_onBehalfOf,

msg.sender,

0,

vars.paybackAmount,

vars.borrowBalanceIncrease,

//solium-disable-next-line

block.timestamp

);

return;

}

vars.paybackAmountMinusFees = vars.paybackAmount.sub(vars.originationFee);

core.updateStateOnRepay(

_reserve,

_onBehalfOf,

vars.paybackAmountMinusFees,

vars.originationFee,

vars.borrowBalanceIncrease,

vars.compoundedBorrowBalance == vars.paybackAmountMinusFees

);

//if the user didn't repay the origination fee, transfer the fee to the fee collection address

if(vars.originationFee > 0) {

core.transferToFeeCollectionAddress.value(vars.isETH ? vars.originationFee : 0)(

_reserve,

msg.sender,

vars.originationFee,

addressesProvider.getTokenDistributor()

);

}

//sending the total msg.value if the transfer is ETH.

//the transferToReserve() function will take care of sending the

//excess ETH back to the caller

core.transferToReserve.value(vars.isETH ? msg.value.sub(vars.originationFee) : 0)(

_reserve,

msg.sender,

vars.paybackAmountMinusFees

);

emit Repay(

_reserve,

_onBehalfOf,

msg.sender,

vars.paybackAmountMinusFees,

vars.originationFee,

vars.borrowBalanceIncrease,

//solium-disable-next-line

block.timestamp

);

}

swapBorrowRate用于更换贷款的利率模式,主要的逻辑就是做一些参数检查然后调用core合约的updateStateOnSwapRate来完成,详见core合约分析小节。

/**

* @dev borrowers can user this function to swap between stable and variable borrow rate modes.

* @param _reserve the address of the reserve on which the user borrowed

**/

function swapBorrowRateMode(address _reserve)

external

nonReentrant

onlyActiveReserve(_reserve)

onlyUnfreezedReserve(_reserve)

{

(uint256 principalBorrowBalance, uint256 compoundedBorrowBalance, uint256 borrowBalanceIncrease) = core

.getUserBorrowBalances(_reserve, msg.sender);

require(

compoundedBorrowBalance > 0,

"User does not have a borrow in progress on this reserve"

);

CoreLibrary.InterestRateMode currentRateMode = core.getUserCurrentBorrowRateMode(

_reserve,

msg.sender

);

if (currentRateMode == CoreLibrary.InterestRateMode.VARIABLE) {

/**

* user wants to swap to stable, before swapping we need to ensure that

* 1. stable borrow rate is enabled on the reserve

* 2. user is not trying to abuse the reserve by depositing

* more collateral than he is borrowing, artificially lowering

* the interest rate, borrowing at variable, and switching to stable

**/

require(

core.isUserAllowedToBorrowAtStable(_reserve, msg.sender, compoundedBorrowBalance),

"User cannot borrow the selected amount at stable"

);

}

(CoreLibrary.InterestRateMode newRateMode, uint256 newBorrowRate) = core

.updateStateOnSwapRate(

_reserve,

msg.sender,

principalBorrowBalance,

compoundedBorrowBalance,

borrowBalanceIncrease,

currentRateMode

);

emit Swap(

_reserve,

msg.sender,

uint256(newRateMode),

newBorrowRate,

borrowBalanceIncrease,

//solium-disable-next-line

block.timestamp

);

}

当用户的借款是稳定利率模式时,可以通过rebalance函数来调整利率数值。有两种情形需要进行rebalance,第一种情况是储备资产的流动比率高于稳定利率,那么此时这一笔贷款就需要重新调整利率。因为在这种情况下用户可以通过将借出的流动性资产放回储备中来进行赚取差额(换句话说就是流动性挖矿的产出比利息高)。第二种情况是用户的稳定利率高于市场平均利率,而且用户的使用率(贷款和抵押的比值)较低,避免用户付出过多的利息。

首先会确定用户的贷款是否符合rebalance的条件。然后会根据上述两种情况判断是否符合,复合的话就进行稳定利率的调整。

/**

* @dev rebalances the stable interest rate of a user if current liquidity rate > user stable rate.

* this is regulated by Aave to ensure that the protocol is not abused, and the user is paying a fair

* rate. Anyone can call this function though.

* @param _reserve the address of the reserve

* @param _user the address of the user to be rebalanced

**/

function rebalanceStableBorrowRate(address _reserve, address _user)

external

nonReentrant

onlyActiveReserve(_reserve)

{

(, uint256 compoundedBalance, uint256 borrowBalanceIncrease) = core.getUserBorrowBalances(

_reserve,

_user

);

//step 1: user must be borrowing on _reserve at a stable rate

require(compoundedBalance > 0, "User does not have any borrow for this reserve");

require(

core.getUserCurrentBorrowRateMode(_reserve, _user) ==

CoreLibrary.InterestRateMode.STABLE,

"The user borrow is variable and cannot be rebalanced"

);

uint256 userCurrentStableRate = core.getUserCurrentStableBorrowRate(_reserve, _user);

uint256 liquidityRate = core.getReserveCurrentLiquidityRate(_reserve);

uint256 reserveCurrentStableRate = core.getReserveCurrentStableBorrowRate(_reserve);

uint256 rebalanceDownRateThreshold = reserveCurrentStableRate.rayMul(

WadRayMath.ray().add(parametersProvider.getRebalanceDownRateDelta())

);

//step 2: we have two possible situations to rebalance:

//1. user stable borrow rate is below the current liquidity rate. The loan needs to be rebalanced,

//as this situation can be abused (user putting back the borrowed liquidity in the same reserve to earn on it)

//2. user stable rate is above the market avg borrow rate of a certain delta, and utilization rate is low.

//In this case, the user is paying an interest that is too high, and needs to be rescaled down.

if (

userCurrentStableRate < liquidityRate ||

userCurrentStableRate > rebalanceDownRateThreshold

) {

uint256 newStableRate = core.updateStateOnRebalance(

_reserve,

_user,

borrowBalanceIncrease

);

emit RebalanceStableBorrowRate(

_reserve,

_user,

newStableRate,

borrowBalanceIncrease,

//solium-disable-next-line

block.timestamp

);

return;

}

revert("Interest rate rebalance conditions were not met");

}

setUserUseReserveAsCollateral用于将用户的储备转换成抵押资产。核心逻辑就是调用core合约的setUserUseReserveAsCollateral函数,详见core合约小节。

/**

* @dev allows depositors to enable or disable a specific deposit as collateral.

* @param _reserve the address of the reserve

* @param _useAsCollateral true if the user wants to user the deposit as collateral, false otherwise.

**/

function setUserUseReserveAsCollateral(address _reserve, bool _useAsCollateral)

external

nonReentrant

onlyActiveReserve(_reserve)

onlyUnfreezedReserve(_reserve)

{

uint256 underlyingBalance = core.getUserUnderlyingAssetBalance(_reserve, msg.sender);

require(underlyingBalance > 0, "User does not have any liquidity deposited");

require(

dataProvider.balanceDecreaseAllowed(_reserve, msg.sender, underlyingBalance),

"User deposit is already being used as collateral"

);

core.setUserUseReserveAsCollateral(_reserve, msg.sender, _useAsCollateral);

if (_useAsCollateral) {

emit ReserveUsedAsCollateralEnabled(_reserve, msg.sender);

} else {

emit ReserveUsedAsCollateralDisabled(_reserve, msg.sender);

}

}

对于资不抵债需要清算的抵押资产,用户可以通过调用liquidationCall来进行资产清算,也就是购买清算资产,同时也会得到一些奖励。具体的逻辑是在liquidationManager中,详见liquidationManager小节。

/**

* @dev users can invoke this function to liquidate an undercollateralized position.

* @param _reserve the address of the collateral to liquidated

* @param _reserve the address of the principal reserve

* @param _user the address of the borrower

* @param _purchaseAmount the amount of principal that the liquidator wants to repay

* @param _receiveAToken true if the liquidators wants to receive the aTokens, false if

* he wants to receive the underlying asset directly

**/

function liquidationCall(

address _collateral,

address _reserve,

address _user,

uint256 _purchaseAmount,

bool _receiveAToken

) external payable nonReentrant onlyActiveReserve(_reserve) onlyActiveReserve(_collateral) {

address liquidationManager = addressesProvider.getLendingPoolLiquidationManager();

//solium-disable-next-line

(bool success, bytes memory result) = liquidationManager.delegatecall(

abi.encodeWithSignature(

"liquidationCall(address,address,address,uint256,bool)",

_collateral,

_reserve,

_user,

_purchaseAmount,

_receiveAToken

)

);

require(success, "Liquidation call failed");

(uint256 returnCode, string memory returnMessage) = abi.decode(result, (uint256, string));

if (returnCode != 0) {

//error found

revert(string(abi.encodePacked("Liquidation failed: ", returnMessage)));

}

}

闪电贷的话就没啥可说的了,每个项目写法都差不多,不同的是在最后会更新一些储备的状态。v1版本的实现只是一个最基本的功能,由于有了重入的限制,所以闪电贷的逻辑不能涉及到aave内部的逻辑:

/**

* @dev allows smartcontracts to access the liquidity of the pool within one transaction,

* as long as the amount taken plus a fee is returned. NOTE There are security concerns for developers of flashloan receiver contracts

* that must be kept into consideration. For further details please visit https://developers.aave.com

* @param _receiver The address of the contract receiving the funds. The receiver should implement the IFlashLoanReceiver interface.

* @param _reserve the address of the principal reserve

* @param _amount the amount requested for this flashloan

**/

function flashLoan(address _receiver, address _reserve, uint256 _amount, bytes memory _params)

public

nonReentrant

onlyActiveReserve(_reserve)

onlyAmountGreaterThanZero(_amount)

{

//check that the reserve has enough available liquidity

//we avoid using the getAvailableLiquidity() function in LendingPoolCore to save gas

uint256 availableLiquidityBefore = _reserve == EthAddressLib.ethAddress()

? address(core).balance

: IERC20(_reserve).balanceOf(address(core));

require(

availableLiquidityBefore >= _amount,

"There is not enough liquidity available to borrow"

);

(uint256 totalFeeBips, uint256 protocolFeeBips) = parametersProvider

.getFlashLoanFeesInBips();

//calculate amount fee

uint256 amountFee = _amount.mul(totalFeeBips).div(10000);

//protocol fee is the part of the amountFee reserved for the protocol - the rest goes to depositors

uint256 protocolFee = amountFee.mul(protocolFeeBips).div(10000);

require(

amountFee > 0 && protocolFee > 0,

"The requested amount is too small for a flashLoan."

);

//get the FlashLoanReceiver instance

IFlashLoanReceiver receiver = IFlashLoanReceiver(_receiver);

address payable userPayable = address(uint160(_receiver));

//transfer funds to the receiver

core.transferToUser(_reserve, userPayable, _amount);

//execute action of the receiver

receiver.executeOperation(_reserve, _amount, amountFee, _params);

//check that the actual balance of the core contract includes the returned amount

uint256 availableLiquidityAfter = _reserve == EthAddressLib.ethAddress()

? address(core).balance

: IERC20(_reserve).balanceOf(address(core));

require(

availableLiquidityAfter == availableLiquidityBefore.add(amountFee),

"The actual balance of the protocol is inconsistent"

);

core.updateStateOnFlashLoan(

_reserve,

availableLiquidityBefore,

amountFee.sub(protocolFee),

protocolFee

);

//solium-disable-next-line

emit FlashLoan(_receiver, _reserve, _amount, amountFee, protocolFee, block.timestamp);

}

LendingPoolConfigurator.sol

用于执行LendingPoolCore合约的配置逻辑,可以启用和停用储备,以及设置不同的协议参数。

initReserve用于初始化储备其主要的逻辑是创建一个新的atoken,然后调用LendingPoolCore合约中initReserve,

/**

* @dev initializes a reserve

* @param _reserve the address of the reserve to be initialized

* @param _underlyingAssetDecimals the decimals of the reserve underlying asset

* @param _interestRateStrategyAddress the address of the interest rate strategy contract for this reserve

**/

function initReserve(

address _reserve,

uint8 _underlyingAssetDecimals,

address _interestRateStrategyAddress

) external onlyLendingPoolManager {

ERC20Detailed asset = ERC20Detailed(_reserve);

string memory aTokenName = string(abi.encodePacked("Aave Interest bearing ", asset.name()));

string memory aTokenSymbol = string(abi.encodePacked("a", asset.symbol()));

initReserveWithData(

_reserve,

aTokenName,

aTokenSymbol,

_underlyingAssetDecimals,

_interestRateStrategyAddress

);

}

/**

* @dev initializes a reserve using aTokenData provided externally (useful if the underlying ERC20 contract doesn't expose name or decimals)

* @param _reserve the address of the reserve to be initialized

* @param _aTokenName the name of the aToken contract

* @param _aTokenSymbol the symbol of the aToken contract

* @param _underlyingAssetDecimals the decimals of the reserve underlying asset

* @param _interestRateStrategyAddress the address of the interest rate strategy contract for this reserve

**/

function initReserveWithData(

address _reserve,

string memory _aTokenName,

string memory _aTokenSymbol,

uint8 _underlyingAssetDecimals,

address _interestRateStrategyAddress

) public onlyLendingPoolManager {

LendingPoolCore core = LendingPoolCore(poolAddressesProvider.getLendingPoolCore());

AToken aTokenInstance = new AToken(

poolAddressesProvider,

_reserve,

_underlyingAssetDecimals,

_aTokenName,

_aTokenSymbol

);

core.initReserve(

_reserve,

address(aTokenInstance),

_underlyingAssetDecimals,

_interestRateStrategyAddress

);

emit ReserveInitialized(

_reserve,

address(aTokenInstance),

_interestRateStrategyAddress

);

}

其他合约参数的逻辑大同小异,都是通过调用core合约中的配置函数来完成设置,这里就不逐个分析了。

LendingPoolCore.sol

字如其名,为整个项目核心,他维护了所有储备和存储资产的状态信息,并且处理一些核心逻辑。其实在代码中体现的维护的逻辑就是记录和更新储备金(reserve)和用户储备数据(userReservedata)两个结构体。具体定义见corelib。

由于代码量过大这里只对于发生写入的函数做详细分析。

core合约利用字典存储了整个项目的储备地址以及用户的储备地址,以及一个外部查询的储备地址动态数组,如下所示:

mapping(address => CoreLibrary.ReserveData) internal reserves;

mapping(address => mapping(address => CoreLibrary.UserReserveData)) internal usersReserveData;

address[] public reservesList;

uint256 public constant CORE_REVISION = 0x6;

updateReserveInterestRatesAndTimestampInternal函数用于计算当前稳定利率和可变利率,并更新时间戳。

function updateReserveInterestRatesAndTimestampInternal(

address _reserve,

uint256 _liquidityAdded,

uint256 _liquidityTaken

) internal {

CoreLibrary.ReserveData storage reserve = reserves[_reserve];

(uint256 newLiquidityRate, uint256 newStableRate, uint256 newVariableRate) = IReserveInterestRateStrategy(

reserve

.interestRateStrategyAddress

)

.calculateInterestRates(

_reserve,

getReserveAvailableLiquidity(_reserve).add(_liquidityAdded).sub(_liquidityTaken),

reserve.totalBorrowsStable,

reserve.totalBorrowsVariable,

reserve.currentAverageStableBorrowRate

);

reserve.currentLiquidityRate = newLiquidityRate;

reserve.currentStableBorrowRate = newStableRate;

reserve.currentVariableBorrowRate = newVariableRate;

//solium-disable-next-line

reserve.lastUpdateTimestamp = uint40(block.timestamp);

emit ReserveUpdated(

_reserve,

newLiquidityRate,

newStableRate,

newVariableRate,

reserve.lastLiquidityCumulativeIndex,

reserve.lastVariableBorrowCumulativeIndex

);

}

transferFlashLoanProtocolFeeInternal用于将闪电贷的协议手续费转给收集地址(addressesProvider.getTokenDistributor())。

function transferFlashLoanProtocolFeeInternal(address _token, uint256 _amount) internal {

address payable receiver = address(uint160(addressesProvider.getTokenDistributor()));

if (_token != EthAddressLib.ethAddress()) {

ERC20(_token).safeTransfer(receiver, _amount);

} else {

//solium-disable-next-line

(bool result, ) = receiver.call.value(_amount)("");

require(result, "Transfer to token distributor failed");

}

}

在core合约创建时,address provider会调用initialize函数,记录lending pool和provider地址信息:

/**

* @dev initializes the Core contract, invoked upon registration on the AddressesProvider

* @param _addressesProvider the addressesProvider contract

**/

function initialize(LendingPoolAddressesProvider _addressesProvider) public initializer {

addressesProvider = _addressesProvider;

refreshConfigInternal();

}

/**

* @dev updates the internal configuration of the core

**/

function refreshConfigInternal() internal {

lendingPoolAddress = addressesProvider.getLendingPool();

}

当用户通过lendingpool合约调用deposit时,lendingpool合约会调用core合约的updateStateOnDeposit函数,更新状态信息,具体分为三步:更新资产累加系数(见coreLiabrary),更新利率以及时间戳,默认存入的资产为流动资产(liquidity),如果是第一次存储,那么这个资产则会被默认当作抵押资产(collateral)。

/**

* @dev updates the state of the core as a result of a deposit action

* @param _reserve the address of the reserve in which the deposit is happening

* @param _user the address of the the user depositing

* @param _amount the amount being deposited

* @param _isFirstDeposit true if the user is depositing for the first time

**/

function updateStateOnDeposit(

address _reserve,

address _user,

uint256 _amount,

bool _isFirstDeposit

) external onlyLendingPool {

reserves[_reserve].updateCumulativeIndexes();

updateReserveInterestRatesAndTimestampInternal(_reserve, _amount, 0);

if (_isFirstDeposit) {

//if this is the first deposit of the user, we configure the deposit as enabled to be used as collateral

setUserUseReserveAsCollateral(_reserve, _user, true);

}

}

当用户通过LendingPool合约赎回自己的抵押资产时,LendingPool合约也会通过调用core合约中的updateStateOnRedeem来更新储备状态,具体做法为:更新资产累加系数(见coreLiabrary),更新利率以及时间戳,由于是赎回资产,所以被认作为去除流动资产,如果用户赎回了所有抵押资产,则将用户抵押资产的储备状态设置为非抵押状态。

/**

* @dev updates the state of the core as a result of a redeem action

* @param _reserve the address of the reserve in which the redeem is happening

* @param _user the address of the the user redeeming

* @param _amountRedeemed the amount being redeemed

* @param _userRedeemedEverything true if the user is redeeming everything

**/

function updateStateOnRedeem(

address _reserve,

address _user,

uint256 _amountRedeemed,

bool _userRedeemedEverything

) external onlyLendingPool {

//compound liquidity and variable borrow interests

reserves[_reserve].updateCumulativeIndexes();

updateReserveInterestRatesAndTimestampInternal(_reserve, 0, _amountRedeemed);

//if user redeemed everything the useReserveAsCollateral flag is reset

if (_userRedeemedEverything) {

setUserUseReserveAsCollateral(_reserve, _user, false);

}

}

同样,当用户通过LendingPool进行闪电贷时,LendingPool合约也会通过调用core合约的updateStateOnFlashLoan函数来更新储备状态,具体做法为:向闪电贷手续费手机合约转入协议费用,更新资产累加系数,记录闪电贷之前的总流动性并通过调用cumulateToLiquidityIndex的方式来更新增加了闪电贷收入后的流动性累加系数,最后更新利率信息。

/**

* @dev updates the state of the core as a result of a flashloan action

* @param _reserve the address of the reserve in which the flashloan is happening

* @param _income the income of the protocol as a result of the action

**/

function updateStateOnFlashLoan(

address _reserve,

uint256 _availableLiquidityBefore,

uint256 _income,

uint256 _protocolFee

) external onlyLendingPool {

transferFlashLoanProtocolFeeInternal(_reserve, _protocolFee);

//compounding the cumulated interest

reserves[_reserve].updateCumulativeIndexes();

uint256 totalLiquidityBefore = _availableLiquidityBefore.add(

getReserveTotalBorrows(_reserve)

);

//compounding the received fee into the reserve

reserves[_reserve].cumulateToLiquidityIndex(totalLiquidityBefore, _income);

//refresh interest rates

updateReserveInterestRatesAndTimestampInternal(_reserve, _income, 0);

}

updateStateOnBorrow用于当用户通过lendingpool合约借贷时,由lendingpool合约调用更新储备信息,具体做法为从借贷用户userReserveData结构体中获得用户的之前的借贷信息,包括借款额和用户的抵押余额,而后根据借贷信息更新用户储备和借贷储备信息,最后更新利率和时间戳,返回新的借贷利率。

/**

* @dev updates the state of the core as a consequence of a borrow action.

* @param _reserve the address of the reserve on which the user is borrowing

* @param _user the address of the borrower

* @param _amountBorrowed the new amount borrowed

* @param _borrowFee the fee on the amount borrowed

* @param _rateMode the borrow rate mode (stable, variable)

* @return the new borrow rate for the user

**/

function updateStateOnBorrow(

address _reserve,

address _user,

uint256 _amountBorrowed,

uint256 _borrowFee,

CoreLibrary.InterestRateMode _rateMode

) external onlyLendingPool returns (uint256, uint256) {

// getting the previous borrow data of the user

(uint256 principalBorrowBalance, , uint256 balanceIncrease) = getUserBorrowBalances(

_reserve,

_user

);

updateReserveStateOnBorrowInternal(

_reserve,

_user,

principalBorrowBalance,

balanceIncrease,

_amountBorrowed,

_rateMode

);

updateUserStateOnBorrowInternal(

_reserve,

_user,

_amountBorrowed,

balanceIncrease,

_borrowFee,

_rateMode

);

updateReserveInterestRatesAndTimestampInternal(_reserve, 0, _amountBorrowed);

return (getUserCurrentBorrowRate(_reserve, _user), balanceIncrease);

}

updateupdateStateOnRepay用于当用户还款时更新储备状态,具体就是调用了updateReserveStateOnRepayInternal和updateUserStateOnRepayInternal函数。

/**

* @dev updates the state of the core as a consequence of a repay action.

* @param _reserve the address of the reserve on which the user is repaying

* @param _user the address of the borrower

* @param _paybackAmountMinusFees the amount being paid back minus fees

* @param _originationFeeRepaid the fee on the amount that is being repaid

* @param _balanceIncrease the accrued interest on the borrowed amount

* @param _repaidWholeLoan true if the user is repaying the whole loan

**/

function updateStateOnRepay(

address _reserve,

address _user,

uint256 _paybackAmountMinusFees,

uint256 _originationFeeRepaid,

uint256 _balanceIncrease,

bool _repaidWholeLoan

) external onlyLendingPool {

updateReserveStateOnRepayInternal(

_reserve,

_user,

_paybackAmountMinusFees,

_balanceIncrease

);

updateUserStateOnRepayInternal(

_reserve,

_user,

_paybackAmountMinusFees,

_originationFeeRepaid,

_balanceIncrease,

_repaidWholeLoan

);

updateReserveInterestRatesAndTimestampInternal(_reserve, _paybackAmountMinusFees, 0);

}

updateReserveStateOnRepayInternal会根据用户的借贷利率模式来分别更新稳定利率信息或者可变利率信息,详见corelib合约。

/**

* @dev updates the state of the reserve as a consequence of a repay action.

* @param _reserve the address of the reserve on which the user is repaying

* @param _user the address of the borrower

* @param _paybackAmountMinusFees the amount being paid back minus fees

* @param _balanceIncrease the accrued interest on the borrowed amount

**/

function updateReserveStateOnRepayInternal(

address _reserve,

address _user,

uint256 _paybackAmountMinusFees,

uint256 _balanceIncrease

) internal {

CoreLibrary.ReserveData storage reserve = reserves[_reserve];

CoreLibrary.UserReserveData storage user = usersReserveData[_user][_reserve];

CoreLibrary.InterestRateMode borrowRateMode = getUserCurrentBorrowRateMode(_reserve, _user);

//update the indexes

reserves[_reserve].updateCumulativeIndexes();

//compound the cumulated interest to the borrow balance and then subtracting the payback amount

if (borrowRateMode == CoreLibrary.InterestRateMode.STABLE) {

reserve.increaseTotalBorrowsStableAndUpdateAverageRate(

_balanceIncrease,

user.stableBorrowRate

);

reserve.decreaseTotalBorrowsStableAndUpdateAverageRate(

_paybackAmountMinusFees,

user.stableBorrowRate

);

} else {

reserve.increaseTotalBorrowsVariable(_balanceIncrease);

reserve.decreaseTotalBorrowsVariable(_paybackAmountMinusFees);

}

}

updateUserStateOnRepayInternal会更新用户在此储备中的状态,如果用户还清了贷款,那么稳定利率和可变借贷累加系数清零。

/**

* @dev updates the state of the user as a consequence of a repay action.

* @param _reserve the address of the reserve on which the user is repaying

* @param _user the address of the borrower

* @param _paybackAmountMinusFees the amount being paid back minus fees

* @param _originationFeeRepaid the fee on the amount that is being repaid

* @param _balanceIncrease the accrued interest on the borrowed amount

* @param _repaidWholeLoan true if the user is repaying the whole loan

**/

function updateUserStateOnRepayInternal(

address _reserve,

address _user,

uint256 _paybackAmountMinusFees,

uint256 _originationFeeRepaid,

uint256 _balanceIncrease,

bool _repaidWholeLoan

) internal {

CoreLibrary.ReserveData storage reserve = reserves[_reserve];

CoreLibrary.UserReserveData storage user = usersReserveData[_user][_reserve];

//update the user principal borrow balance, adding the cumulated interest and then subtracting the payback amount

user.principalBorrowBalance = user.principalBorrowBalance.add(_balanceIncrease).sub(

_paybackAmountMinusFees

);

user.lastVariableBorrowCumulativeIndex = reserve.lastVariableBorrowCumulativeIndex;

//if the balance decrease is equal to the previous principal (user is repaying the whole loan)

//and the rate mode is stable, we reset the interest rate mode of the user

if (_repaidWholeLoan) {

user.stableBorrowRate = 0;

user.lastVariableBorrowCumulativeIndex = 0;

}

user.originationFee = user.originationFee.sub(_originationFeeRepaid);

//solium-disable-next-line

user.lastUpdateTimestamp = uint40(block.timestamp);

}

当用户发生转换利率模式时,lendingpool合约会调用updateStateOnSwapRate函数,主体逻辑和repay差不多,都是通过调用两个内部函数的方式来更新储备金状态和用户储备状态,不过这里需要注意的是之前贷款的利息会被加到借款总额中。

/**

* @dev updates the state of the core as a consequence of a swap rate action.

* @param _reserve the address of the reserve on which the user is repaying

* @param _user the address of the borrower

* @param _principalBorrowBalance the amount borrowed by the user

* @param _compoundedBorrowBalance the amount borrowed plus accrued interest

* @param _balanceIncrease the accrued interest on the borrowed amount

* @param _currentRateMode the current interest rate mode for the user

**/

function updateStateOnSwapRate(

address _reserve,

address _user,

uint256 _principalBorrowBalance,

uint256 _compoundedBorrowBalance,

uint256 _balanceIncrease,

CoreLibrary.InterestRateMode _currentRateMode

) external onlyLendingPool returns (CoreLibrary.InterestRateMode, uint256) {

updateReserveStateOnSwapRateInternal(

_reserve,

_user,

_principalBorrowBalance,

_compoundedBorrowBalance,

_currentRateMode

);

CoreLibrary.InterestRateMode newRateMode = updateUserStateOnSwapRateInternal(

_reserve,

_user,

_balanceIncrease,

_currentRateMode

);

updateReserveInterestRatesAndTimestampInternal(_reserve, 0, 0);

return (newRateMode, getUserCurrentBorrowRate(_reserve, _user));

}

updateReserveStateOnSwapRateInternal的核心逻辑就是将远利率状态的参数清零并设置另一个利率模式的参数,具体的,在这里只是简单的将存款从一个利率模式转移到另一个利率模式的储备金中。

/**

* @dev updates the state of the user as a consequence of a swap rate action.

* @param _reserve the address of the reserve on which the user is performing the rate swap

* @param _user the address of the borrower

* @param _principalBorrowBalance the the principal amount borrowed by the user

* @param _compoundedBorrowBalance the principal amount plus the accrued interest

* @param _currentRateMode the rate mode at which the user borrowed

**/

function updateReserveStateOnSwapRateInternal(

address _reserve,

address _user,

uint256 _principalBorrowBalance,

uint256 _compoundedBorrowBalance,

CoreLibrary.InterestRateMode _currentRateMode

) internal {

CoreLibrary.ReserveData storage reserve = reserves[_reserve];

CoreLibrary.UserReserveData storage user = usersReserveData[_user][_reserve];

//compounding reserve indexes

reserve.updateCumulativeIndexes();

if (_currentRateMode == CoreLibrary.InterestRateMode.STABLE) {

uint256 userCurrentStableRate = user.stableBorrowRate;

//swap to variable

reserve.decreaseTotalBorrowsStableAndUpdateAverageRate(

_principalBorrowBalance,

userCurrentStableRate

); //decreasing stable from old principal balance

reserve.increaseTotalBorrowsVariable(_compoundedBorrowBalance); //increase variable borrows

} else if (_currentRateMode == CoreLibrary.InterestRateMode.VARIABLE) {

//swap to stable

uint256 currentStableRate = reserve.currentStableBorrowRate;

reserve.decreaseTotalBorrowsVariable(_principalBorrowBalance);

reserve.increaseTotalBorrowsStableAndUpdateAverageRate(

_compoundedBorrowBalance,

currentStableRate

);

} else {

revert("Invalid rate mode received");

}

}

利率的更新转换和记录体现在updateUserStateOnSwapRateInternal中,也就是说,用户的结构体中记录了利率的信息。具体的做法就是将用户结构体中之前利率模式的信息清零,稳定利率为stableBorrowRate,可变利率为lastVariableBorrowCumulativeIndex,两种利率都初始化为储备结构体中存储的信息。在最后将之前产生的利息加到借款总额中。

/**

* @dev updates the state of the user as a consequence of a swap rate action.

* @param _reserve the address of the reserve on which the user is performing the swap

* @param _user the address of the borrower

* @param _balanceIncrease the accrued interest on the borrowed amount

* @param _currentRateMode the current rate mode of the user

**/

function updateUserStateOnSwapRateInternal(

address _reserve,

address _user,

uint256 _balanceIncrease,

CoreLibrary.InterestRateMode _currentRateMode

) internal returns (CoreLibrary.InterestRateMode) {

CoreLibrary.UserReserveData storage user = usersReserveData[_user][_reserve];

CoreLibrary.ReserveData storage reserve = reserves[_reserve];

CoreLibrary.InterestRateMode newMode = CoreLibrary.InterestRateMode.NONE;

if (_currentRateMode == CoreLibrary.InterestRateMode.VARIABLE) {

//switch to stable

newMode = CoreLibrary.InterestRateMode.STABLE;

user.stableBorrowRate = reserve.currentStableBorrowRate;

user.lastVariableBorrowCumulativeIndex = 0;

} else if (_currentRateMode == CoreLibrary.InterestRateMode.STABLE) {

newMode = CoreLibrary.InterestRateMode.VARIABLE;

user.stableBorrowRate = 0;

user.lastVariableBorrowCumulativeIndex = reserve.lastVariableBorrowCumulativeIndex;

} else {

revert("Invalid interest rate mode received");

}

//compounding cumulated interest

user.principalBorrowBalance = user.principalBorrowBalance.add(_balanceIncrease);

//solium-disable-next-line

user.lastUpdateTimestamp = uint40(block.timestamp);

return newMode;

}

updateStateOnLiquidation用于发生资产清算时更新储备的状态信息,在这里principalReserve指的是用于偿还储备(reserve)地址,collateralReserve指的是被清算的抵押资产,user指的是被清算资产的所有者,amountToLiquidate是指清算人偿还的资金,collateralToLiquidate指的是被清算的抵押资产的数目,feeLiquidated指的是抵押贷款的办理费,liquidatedCollateralForFee指的是清算资产费用,等价于抵押贷款办理费加清算人购买清算抵押资产的奖金,balanceIncrease指的是应付未付利息,liquidatorReceivesAToken指的是清算方是否接受atoken。

整个函数的逻辑就是调用三个更新状态的内部函数,如下:

/**

* @dev updates the state of the core as a consequence of a liquidation action.

* @param _principalReserve the address of the principal reserve that is being repaid

* @param _collateralReserve the address of the collateral reserve that is being liquidated

* @param _user the address of the borrower

* @param _amountToLiquidate the amount being repaid by the liquidator

* @param _collateralToLiquidate the amount of collateral being liquidated

* @param _feeLiquidated the amount of origination fee being liquidated

* @param _liquidatedCollateralForFee the amount of collateral equivalent to the origination fee + bonus

* @param _balanceIncrease the accrued interest on the borrowed amount

* @param _liquidatorReceivesAToken true if the liquidator will receive aTokens, false otherwise

**/

function updateStateOnLiquidation(

address _principalReserve,

address _collateralReserve,

address _user,

uint256 _amountToLiquidate,

uint256 _collateralToLiquidate,

uint256 _feeLiquidated,

uint256 _liquidatedCollateralForFee,

uint256 _balanceIncrease,

bool _liquidatorReceivesAToken

) external onlyLendingPool {

updatePrincipalReserveStateOnLiquidationInternal(

_principalReserve,

_user,

_amountToLiquidate,

_balanceIncrease

);

updateCollateralReserveStateOnLiquidationInternal(

_collateralReserve

);

updateUserStateOnLiquidationInternal(

_principalReserve,

_user,

_amountToLiquidate,

_feeLiquidated,

_balanceIncrease

);

updateReserveInterestRatesAndTimestampInternal(_principalReserve, _amountToLiquidate, 0);

if (!_liquidatorReceivesAToken) {

updateReserveInterestRatesAndTimestampInternal(

_collateralReserve,

0,

_collateralToLiquidate.add(_liquidatedCollateralForFee)

);

}

}

我们逐个分析。

首先updatePrincipalReserveStateOnLiquidationInternal用于更新被清算资产储备的状态,可以看到首先会判断清算资产的利率模式,然后根据利率模式将应付未付利息增加到储备金中,而后将被清算资产的总额从储备金中剔除。主要就是做了储备的资金调整:

/**

* @dev updates the state of the principal reserve as a consequence of a liquidation action.

* @param _principalReserve the address of the principal reserve that is being repaid

* @param _user the address of the borrower

* @param _amountToLiquidate the amount being repaid by the liquidator

* @param _balanceIncrease the accrued interest on the borrowed amount

**/

function updatePrincipalReserveStateOnLiquidationInternal(

address _principalReserve,

address _user,

uint256 _amountToLiquidate,

uint256 _balanceIncrease

) internal {

CoreLibrary.ReserveData storage reserve = reserves[_principalReserve];

CoreLibrary.UserReserveData storage user = usersReserveData[_user][_principalReserve];

//update principal reserve data

reserve.updateCumulativeIndexes();

CoreLibrary.InterestRateMode borrowRateMode = getUserCurrentBorrowRateMode(

_principalReserve,

_user

);

if (borrowRateMode == CoreLibrary.InterestRateMode.STABLE) {

//increase the total borrows by the compounded interest

reserve.increaseTotalBorrowsStableAndUpdateAverageRate(

_balanceIncrease,

user.stableBorrowRate

);

//decrease by the actual amount to liquidate

reserve.decreaseTotalBorrowsStableAndUpdateAverageRate(

_amountToLiquidate,

user.stableBorrowRate

);

} else {

//increase the total borrows by the compounded interest

reserve.increaseTotalBorrowsVariable(_balanceIncrease);

//decrease by the actual amount to liquidate

reserve.decreaseTotalBorrowsVariable(_amountToLiquidate);

}

}

当更新完了储备的资金变动后,会调用updateCollateralReserveStateOnLiquidationInternal,逻辑很简单,就是更新一下储备的累加指数:

/**

* @dev updates the state of the collateral reserve as a consequence of a liquidation action.

* @param _collateralReserve the address of the collateral reserve that is being liquidated

**/

function updateCollateralReserveStateOnLiquidationInternal(

address _collateralReserve

) internal {

//update collateral reserve

reserves[_collateralReserve].updateCumulativeIndexes();

}

更新完了储备金状态后,就会调用updateUserStateOnLiquidationInternal更新用户的储备状态,具体逻辑就是将应付未付资金算到用户头上,然后将用户的被清算总额从贷款中减去。而后判断用户的利率模式,如果是可变利率模式那么就更新用户可变贷款累加系数为最新(上一步更新),如果清算手续费大于0,那么久从用户的清算手续费中扣除:

/**

* @dev updates the state of the user being liquidated as a consequence of a liquidation action.

* @param _reserve the address of the principal reserve that is being repaid

* @param _user the address of the borrower

* @param _amountToLiquidate the amount being repaid by the liquidator

* @param _feeLiquidated the amount of origination fee being liquidated

* @param _balanceIncrease the accrued interest on the borrowed amount

**/

function updateUserStateOnLiquidationInternal(

address _reserve,

address _user,

uint256 _amountToLiquidate,

uint256 _feeLiquidated,

uint256 _balanceIncrease

) internal {

CoreLibrary.UserReserveData storage user = usersReserveData[_user][_reserve];

CoreLibrary.ReserveData storage reserve = reserves[_reserve];

//first increase by the compounded interest, then decrease by the liquidated amount

user.principalBorrowBalance = user.principalBorrowBalance.add(_balanceIncrease).sub(

_amountToLiquidate

);

if (

getUserCurrentBorrowRateMode(_reserve, _user) == CoreLibrary.InterestRateMode.VARIABLE

) {

user.lastVariableBorrowCumulativeIndex = reserve.lastVariableBorrowCumulativeIndex;

}

if(_feeLiquidated > 0){

user.originationFee = user.originationFee.sub(_feeLiquidated);

}

//solium-disable-next-line

user.lastUpdateTimestamp = uint40(block.timestamp);

}

而后调用updateReserveInterestRatesAndTimestampInternal更新偿还储备的利率。

最后根据清算人是否接受atoken来判断是否改变抵押资产储备的状态,如果用户不接受atoken,那么就直接从抵押贷款中扣除相关费用。

updateStateOnRebalance用于当稳定利率重新平衡时更新储备信息,主要的逻辑就是先更新储备的状态,然后更新用户储备状态,最后更新储备利率信息,由三个内部函数调用组成,最后返回新的稳定利率,如下:

/**

* @dev updates the state of the core as a consequence of a stable rate rebalance

* @param _reserve the address of the principal reserve where the user borrowed

* @param _user the address of the borrower

* @param _balanceIncrease the accrued interest on the borrowed amount

* @return the new stable rate for the user

**/

function updateStateOnRebalance(address _reserve, address _user, uint256 _balanceIncrease)

external

onlyLendingPool

returns (uint256)

{

updateReserveStateOnRebalanceInternal(_reserve, _user, _balanceIncrease);

//update user data and rebalance the rate

updateUserStateOnRebalanceInternal(_reserve, _user, _balanceIncrease);

updateReserveInterestRatesAndTimestampInternal(_reserve, 0, 0);

return usersReserveData[_user][_reserve].stableBorrowRate;

}

updateReserveStateOnRebalanceInternal逻辑很简单,就是将用户的应付未付利息加到总储备中,然后更新稳定利率。

/**

* @dev updates the state of the reserve as a consequence of a stable rate rebalance

* @param _reserve the address of the principal reserve where the user borrowed

* @param _user the address of the borrower

* @param _balanceIncrease the accrued interest on the borrowed amount

**/

function updateReserveStateOnRebalanceInternal(

address _reserve,

address _user,

uint256 _balanceIncrease

) internal {

CoreLibrary.ReserveData storage reserve = reserves[_reserve];

CoreLibrary.UserReserveData storage user = usersReserveData[_user][_reserve];

reserve.updateCumulativeIndexes();

reserve.increaseTotalBorrowsStableAndUpdateAverageRate(

_balanceIncrease,

user.stableBorrowRate

);

}

updateUserStateOnRebalanceInternal将用户的应付未付利息算进用户的借贷额中,然后更新用户稳定利率为上一步计算得到的新的利率

/**

* @dev updates the state of the user as a consequence of a stable rate rebalance

* @param _reserve the address of the principal reserve where the user borrowed

* @param _user the address of the borrower

* @param _balanceIncrease the accrued interest on the borrowed amount

**/

function updateUserStateOnRebalanceInternal(

address _reserve,

address _user,

uint256 _balanceIncrease

) internal {

CoreLibrary.UserReserveData storage user = usersReserveData[_user][_reserve];

CoreLibrary.ReserveData storage reserve = reserves[_reserve];

user.principalBorrowBalance = user.principalBorrowBalance.add(_balanceIncrease);

user.stableBorrowRate = reserve.currentStableBorrowRate;

//solium-disable-next-line

user.lastUpdateTimestamp = uint40(block.timestamp);

}

至此,core合约中所有关键的状态信息维护函数分析完毕。

LendingPoolLiquidationManager.sol

主要用于执行资产清算的逻辑。

主体就两个函数,但是比较复杂。

calculateAvailableCollateralToLiquidate函数用于计算对于特定的购买资产目标抵押资产中有多少可以被清算。首先从预言机获取当前购买使用资产和被清算资产的价格,同时从core合约中获取清算奖励系数。之后计算当前用于购买的资产的总额可以购买多少清算资产并加上奖励系数,如果这个值大于用户抵押资产总额,那么就按照全部清算的价格更新清算者实际花费的资产。如果低于,则不用更新花费数额。最后,将刚才得出的实际会被购买的清算资产总额和实际花费的资产总额返回。

struct AvailableCollateralToLiquidateLocalVars {

uint256 userCompoundedBorrowBalance;

uint256 liquidationBonus;

uint256 collateralPrice;

uint256 principalCurrencyPrice;

uint256 maxAmountCollateralToLiquidate;

}

/**

* @dev calculates how much of a specific collateral can be liquidated, given

* a certain amount of principal currency. This function needs to be called after

* all the checks to validate the liquidation have been performed, otherwise it might fail.

* @param _collateral the collateral to be liquidated

* @param _principal the principal currency to be liquidated

* @param _purchaseAmount the amount of principal being liquidated

* @param _userCollateralBalance the collatera balance for the specific _collateral asset of the user being liquidated

* @return the maximum amount that is possible to liquidated given all the liquidation constraints (user balance, close factor) and

* the purchase amount

**/

function calculateAvailableCollateralToLiquidate(

address _collateral,

address _principal,

uint256 _purchaseAmount,

uint256 _userCollateralBalance

) internal view returns (uint256 collateralAmount, uint256 principalAmountNeeded) {

collateralAmount = 0;

principalAmountNeeded = 0;

IPriceOracleGetter oracle = IPriceOracleGetter(addressesProvider.getPriceOracle());

// Usage of a memory struct of vars to avoid "Stack too deep" errors due to local variables

AvailableCollateralToLiquidateLocalVars memory vars;

vars.collateralPrice = oracle.getAssetPrice(_collateral);

vars.principalCurrencyPrice = oracle.getAssetPrice(_principal);

vars.liquidationBonus = core.getReserveLiquidationBonus(_collateral);

//this is the maximum possible amount of the selected collateral that can be liquidated, given the

//max amount of principal currency that is available for liquidation.

vars.maxAmountCollateralToLiquidate = vars

.principalCurrencyPrice

.mul(_purchaseAmount)

.div(vars.collateralPrice)

.mul(vars.liquidationBonus)

.div(100);

if (vars.maxAmountCollateralToLiquidate > _userCollateralBalance) {

collateralAmount = _userCollateralBalance;

principalAmountNeeded = vars

.collateralPrice

.mul(collateralAmount)

.div(vars.principalCurrencyPrice)

.mul(100)

.div(vars.liquidationBonus);

} else {

collateralAmount = vars.maxAmountCollateralToLiquidate;

principalAmountNeeded = _purchaseAmount;

}

return (collateralAmount, principalAmountNeeded);

}

}

对于清算函数,首先声明了一个局部的结构体用于记录用户储备信息:

struct LiquidationCallLocalVars {

uint256 userCollateralBalance;

uint256 userCompoundedBorrowBalance;

uint256 borrowBalanceIncrease;

uint256 maxPrincipalAmountToLiquidate;

uint256 actualAmountToLiquidate;

uint256 liquidationRatio;

uint256 collateralPrice;

uint256 principalCurrencyPrice;

uint256 maxAmountCollateralToLiquidate;

uint256 originationFee;

uint256 feeLiquidated;

uint256 liquidatedCollateralForFee;

CoreLibrary.InterestRateMode borrowRateMode;

uint256 userStableRate;

bool isCollateralEnabled;

bool healthFactorBelowThreshold;

}

首先进行一系列的检查,包括抵押资产的健康系数、用户的抵押资产金额、用户储备是否被设置为抵押资产、用户是否有借款。当这一系列的检查通过后才会执行之后的清算逻辑。

LiquidationCallLocalVars memory vars;

(, , , , , , , vars.healthFactorBelowThreshold) = dataProvider.calculateUserGlobalData(

_user

);

if (!vars.healthFactorBelowThreshold) {

return (

uint256(LiquidationErrors.HEALTH_FACTOR_ABOVE_THRESHOLD),

"Health factor is not below the threshold"

);

}

vars.userCollateralBalance = core.getUserUnderlyingAssetBalance(_collateral, _user);

//if _user hasn't deposited this specific collateral, nothing can be liquidated

if (vars.userCollateralBalance == 0) {

return (

uint256(LiquidationErrors.NO_COLLATERAL_AVAILABLE),

"Invalid collateral to liquidate"

);

}

vars.isCollateralEnabled =

core.isReserveUsageAsCollateralEnabled(_collateral) &&

core.isUserUseReserveAsCollateralEnabled(_collateral, _user);

//if _collateral isn't enabled as collateral by _user, it cannot be liquidated

if (!vars.isCollateralEnabled) {

return (